How to file gst return pdf Georgian Sands Beach

Download GST Return file in pdf format caclubindia.com Filing Process of GST Annual Return GSTR 9 (GSTR-9, 9A & 9C): All companies (private limited company, one person company, limited company, section 8 company, etc) are required to file an annual return with the MCA every year.

How to file TCS Return in GST studycafe.in

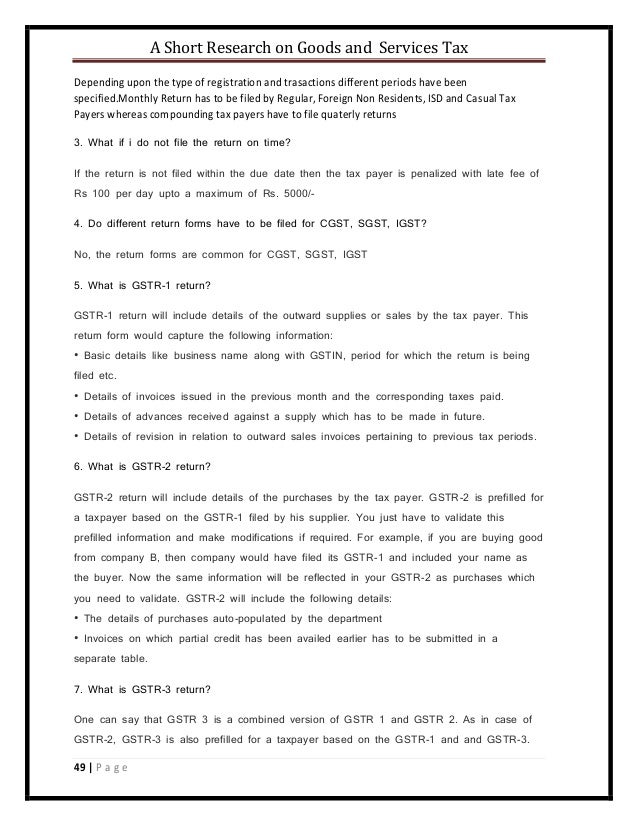

Download GST Return file in pdf format caclubindia.com. In your online company file, go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears. In the File Online tab, click Prepare GST Return and a browser window will appear., A return is a document that a taxpayer is required to file as per the law with the tax administrative authorities. Under the GST law, a normal taxpayer will be required to furnish three returns monthly and one annual return..

In this article, we’ve explained various types of GST Returns, who should file GST returns online, the format of GST return, the process of filing GST return and much more.. UPDATE: 28th GST council meet held on 21st of July 2018 has introduced a simple GST return filing system for the taxpayers. 2 1. FURNISHING OF RETURNS 1.1 File A Return (GST - 03) - For Taxpayers Who Have Accounting Software 1. Login ID (email address). 2. Password (specified during registration).

Here we provide all the updated GST form including final GST rules, rules related to the registration and amendments, GST forms related to the returns/statements, invoice formats and transition and migration-related GST forms. Share your GST Login details along with all of your purchases and sales details for filing GST Returns. Step - 3 We will make a detailed summary for the GST return in …

3 List of GST Returns/Statements to be furnished by Registered Persons 1 Form GSTR-1 Details of outward supplies of taxable goods and/or services effected Click the FILE GSTR-3B WITH EVC button or other type of Return option to File GST Return with EVC 5. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

Get the easy guide to GSTR 9C along with complete online return filing process. GSTR 9C is a GST audit form for taxpayers having turnover more than 2 crores. GSTR 9C is a GST audit form for taxpayers having turnover more than 2 crores. 2 1. FURNISHING OF RETURNS 1.1 File A Return (GST - 03) - For Taxpayers Who Have Accounting Software 1. Login ID (email address). 2. Password (specified during registration).

Who is required to file GST Annual return. Every registered person, other than an Input Service Distributor, a person paying tax under section 51 of CGST Act 2017 or section 52 of CGST Act 2017, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and Get the easy guide to GSTR 9C along with complete online return filing process. GSTR 9C is a GST audit form for taxpayers having turnover more than 2 crores. GSTR 9C is a GST audit form for taxpayers having turnover more than 2 crores.

In this article, we’ve explained various types of GST Returns, who should file GST returns online, the format of GST return, the process of filing GST return and much more.. UPDATE: 28th GST council meet held on 21st of July 2018 has introduced a simple GST return filing system for the taxpayers. GSTR Returns in PDF and Excel Format. Last updated at Dec. 3, 2018 by Teachoo. Form no. Description GSTR 1 How to file nil amount return of GSTR1 GST Return E-filing Training Form no. Description GSTR 1A Auto Drafted Details Download GSTR 1A in PDF Format Form GSTR-1A.pdf

What are the steps for filing the TRAN-2 form on GST Portal? The first step is to login to the GST portal (www.gst.gov.in). Next, click on “ Services ”, then “ Returns ” and after that click on … 1. Introduction. Form 3B is a return form in lieu of FORM GSTR-3 and thus, is to be filed by only those persons who are liable to file Form 3 viz., persons other than Compositions dealers, or an Input Service Distributor or a non-resident taxable person or a person responsible for deducting or colleting tax at source under section 51 or section

Download GSTR 3 Form - GST Monthly Return Form. Download Form GSTR 3 in PDF Format. Here we provide GST Return Form GSTR - 3 in PDF Format. This from is applicable for "Monthly return (other than compounding taxpayer and ISD)" and this form is require to submit 20th of every month as per GST model Law. We shall provide you new patch by Aug 10 to download and file GST Returns. You will have to register yourself with GST and make payment on online payment gateway of GSP for the same.

Under GST, returns are required to be filled every month. Return Purpose of Return Due Date of filing return GSTR 1 Outward Supplies of every month requires to be reported like Sale Stock transfer to other branch Export Any other movement of goods 10th of every next month* Illustration For the month of April, return requires to be file on or before 10th May GSTR 2 Inward Supplies of every Share your GST Login details along with all of your purchases and sales details for filing GST Returns. Step - 3 We will make a detailed summary for the GST return in …

Filing your GST return with us Find out about submitting your GST return and making GST payments to us and learn how to avoid interests and penalties. Learn about Presently, the draft business processes on GST returns, GST registration, GST refunds and GST payments are being published. The Report of the Committee on GST Returns is available here . Comments and views are invited on these business processes by 6th November, 2015 .

GST Return Filing Online How to file GST returnGST

GST Forms Return Filing Rule Registration Challan. Most Indian businesses have started complying with GST after 1st July 2017. Now, invoices and bills are being raised in the GST format. After the initial glitches in filing monthly returns, Government has taken various steps to simplify GST Return Filing., Share your GST Login details along with all of your purchases and sales details for filing GST Returns. Step - 3 We will make a detailed summary for the GST return in ….

How to file GSTR 1 a step by step guide Tally Solutions. As per the guidelines set by the GST Council, a registered taxable person is to follow a standard return filing process, involving 3 forms – outward supplies details in GSTR 1 form by 10th of the following month, corrections (if any) in GSTR 2 form by the 15th and finally the auto-populated GSTR 3 form for final submission and payment, by the 20th., 7/08/2017 · GST RETURN 3B FILING for July and August File your GSTR 3B before 20 Aug &20 Sep Online Live Demo Form GSTR-3B needs to be filed by a taxable person under GST for ….

GST Forms Return Filing Rule Registration Challan

Download GSTR-3B Format How To File Due Date & More. Download GSTR 3 Form - GST Monthly Return Form. Download Form GSTR 3 in PDF Format. Here we provide GST Return Form GSTR - 3 in PDF Format. This from is applicable for "Monthly return (other than compounding taxpayer and ISD)" and this form is require to submit 20th of every month as per GST model Law. GSTR 9 Annual Return Format in Excel /PDF The Govt. has notified Central GST (Eighth Amendment) Rules, 2018 by Notification No 39/2018 Central Tax Dated 4th September 2018 wherein it has notified Form GSTR-9 of Annual Return which is required to be filed as per Rule 80 of CGST Rules 2017 and.

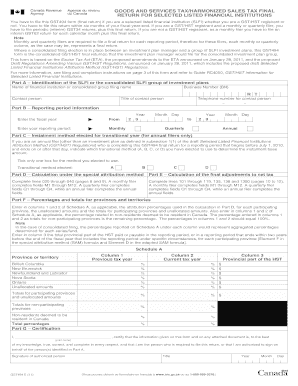

Get more details for How to File GST Return online, Every registered taxable person has to furnish outward supply details in Form GSTR-1 by the 10th of the subsequent month. . here you may download GST Return Formats in Excel and PDF Format, This document lists out the salient aspects of the process related to filing of Returns under GST. 3 Filing ales ax 5 The Prepare Sales Tax window displays the information that was displayed in the sales tax report you just created. 6 Click File Return to complete the GST/HST return process.

As per the guidelines set by the GST Council, a registered taxable person is to follow a standard return filing process, involving 3 forms – outward supplies details in GSTR 1 form by 10th of the following month, corrections (if any) in GSTR 2 form by the 15th and finally the auto-populated GSTR 3 form for final submission and payment, by the 20th. STEP 2 Step: 2 GSTR-9 is basically used for GST annual return filing and it is compulsory for all the regular taxpayers

In your online company file, go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears. In the File Online tab, click Prepare GST Return and a browser window will appear. GST F7 return for disclosing errors on GST returns filed previously GST F8 return for final filing of GST You may access the GST F5, F7 and F8 returns online via myTax Portal if they are due for filing.

BAS P – Annual GST return You can use the BAS P sample document for information if you report and pay GST (or claim a refund) annually, or you pay GST by instalments and report annually. From the 2017–18 financial year, you do not need to complete labels G2, G3, G10 and G11 on your annual GST return. Click the FILE GSTR-3B WITH EVC button or other type of Return option to File GST Return with EVC 5. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

In this article, we’ve explained various types of GST Returns, who should file GST returns online, the format of GST return, the process of filing GST return and much more.. UPDATE: 28th GST council meet held on 21st of July 2018 has introduced a simple GST return filing system for the taxpayers. 3 Filing ales ax 5 The Prepare Sales Tax window displays the information that was displayed in the sales tax report you just created. 6 Click File Return to complete the GST/HST return process.

Download GSTR 3 Form - GST Monthly Return Form. Download Form GSTR 3 in PDF Format. Here we provide GST Return Form GSTR - 3 in PDF Format. This from is applicable for "Monthly return (other than compounding taxpayer and ISD)" and this form is require to submit 20th of every month as per GST model Law. Other than the monthly returns, they are also required to file one annual return. In this guide, you will learn about the most common annual return form under GST, also known as GSTR 9. What is the annual return under GST? It is a GST return to be filed by the taxpayers annually. It gives the government a detailed picture of t...

How to file TCS Return in GST : Form GSTR-8 is a Statement of TCS (Tax Collected at Source) to be filed by E Commerce Operators. Form GSTR-8 contains the details of taxable supplies and the amount of consideration collected by such operator pertaining to the supplies made by other suppliers through such e commerce operator and amount of TCS BAS P – Annual GST return You can use the BAS P sample document for information if you report and pay GST (or claim a refund) annually, or you pay GST by instalments and report annually. From the 2017–18 financial year, you do not need to complete labels G2, G3, G10 and G11 on your annual GST return.

In your online company file, go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears. In the File Online tab, click Prepare GST Return and a browser window will appear. Filing your GST return with us Find out about submitting your GST return and making GST payments to us and learn how to avoid interests and penalties. Learn about

Using this sheet user can convert PDF file in excel and get the (GSRT-3B and GSTR-1) data in tabular format. after that the data fill in tally, the difference sheet will prepare automatically. GST monthly return filing is a little complex task as matching and reversal task are also involved under GST return filing procedure. If there is any discrepancy in filing between seller and buyer, then the same has to be reconciled. Let us understand the full procedure:

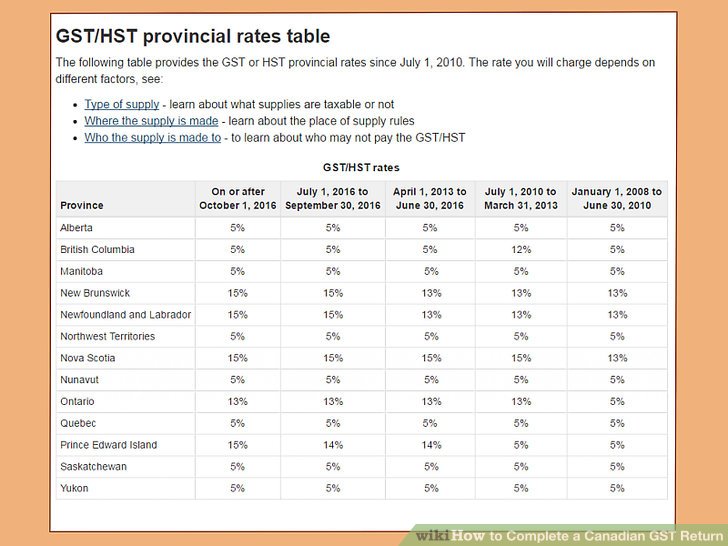

Using this sheet user can convert PDF file in excel and get the (GSRT-3B and GSTR-1) data in tabular format. after that the data fill in tally, the difference sheet will prepare automatically. Generally, you have to file a GST/HST return for every reporting period, even if the return reports a zero balance. If you are using the Quick Method of accounting, see Guide RC4058, Quick

As per the guidelines set by the GST Council, a registered taxable person is to follow a standard return filing process, involving 3 forms – outward supplies details in GSTR 1 form by 10th of the following month, corrections (if any) in GSTR 2 form by the 15th and finally the auto-populated GSTR 3 form for final submission and payment, by the 20th. In your online company file, go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears. In the File Online tab, click Prepare GST Return and a browser window will appear.

Types Of GST Returns Format How To File & Due Dates

Tips on GST Return Filing Debits And Credits Taxes. 7/08/2017 · GST RETURN 3B FILING for July and August File your GSTR 3B before 20 Aug &20 Sep Online Live Demo Form GSTR-3B needs to be filed by a taxable person under GST for …, GST is the system that simplifies indirect tax system India.GST Return Filing is mandatory GST Compliance need to be under GST regime. GST Return Filing must be filed by the taxperson registered under GST.GST return must be filed even if the zero has taken place..

GST regime to have 8 forms for filing tax returns Times

Types Of GST Returns Format How To File & Due Dates. Partnership tax return 2018. The Partnership tax return 2018 (NAT 0659-6.2018) is available in Portable Document Format (PDF). Next steps: Download a PDF of the Partnership tax return 2018 (PDF, 323KB) This link will download a file, Generally, you have to file a GST/HST return for every reporting period, even if the return reports a zero balance. If you are using the Quick Method of accounting, see Guide RC4058, Quick.

Completing GST Return. General tips and instructions on completing your GST F5 Return are listed below. Jump To . Select Subheading. Before Filing Your GST F5 Return; Before Filing Your GST F5 Return. The form GST F5 Return has thirteen boxes that you must fill. You can access your GST returns by logging in to myTax Portal. All figures reported in the GST Return must be in Singapore … We shall provide you new patch by Aug 10 to download and file GST Returns. You will have to register yourself with GST and make payment on online payment gateway of GSP for the same.

The least complicated way to file your GST-HST return from a complete worksheet is to just sign and date the worksheet itself and mail it in. Technically a Worksheet is different from a return; but it contains all the same data, and once validated with your signature and the date it … Completing GST Return. General tips and instructions on completing your GST F5 Return are listed below. Jump To . Select Subheading. Before Filing Your GST F5 Return; Before Filing Your GST F5 Return. The form GST F5 Return has thirteen boxes that you must fill. You can access your GST returns by logging in to myTax Portal. All figures reported in the GST Return must be in Singapore …

It is very much easy to prepare GST returns in Tally.ERP 9 (simply Tally) because you do not have to actually prepare the returns. You just have to create Sales and Purchase bills and the returns will be created automatically . Form GSTR-2 Return Filing, Format and Due Date In our previous article we discussed the revised heads, new formats and return filing procedure of the GSTR-1 FORM which should be filed by the taxpayer for his outward supplies made.

GST Return Filing Process might look elaborate, but with the help of secure GST software, it can be simplified up to maximum extent. Taxmann’s One Solution helps with GST billing, invoicing and subsequent filing from a single platform. The taxpayer does not have to leave the software for GSTN portal as everything can be performed from the Using this sheet user can convert PDF file in excel and get the (GSRT-3B and GSTR-1) data in tabular format. after that the data fill in tally, the difference sheet will prepare automatically.

Here we provide all the updated GST form including final GST rules, rules related to the registration and amendments, GST forms related to the returns/statements, invoice formats and transition and migration-related GST forms. How to file GSTR2. Last updated at Dec. 5, 2018 by Teachoo. Note- Date for GSTR2 for July has been extended. It is 30 November 2017 What is GSTR2 ? GSTR2 Return is the Return of Purchases of GST It contains details of both normal purchases as well as reverse charge purchases for the month What is the due date of GSTR2? Normally due date for GSTR2 is 15 th of next month Hence Due date for …

To file GSTR-1 returns follow these instructions as given below:-1. Log in to the www.gst.gov.in Website. 2. Click Services > Returns > Returns Dashboard. In your online company file, go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears. In the File Online tab, click Prepare GST Return and a browser window will appear.

Filing your GST return with us Find out about submitting your GST return and making GST payments to us and learn how to avoid interests and penalties. Learn about Filing your GST return with us Find out about submitting your GST return and making GST payments to us and learn how to avoid interests and penalties. Learn about

GSTR Returns in PDF and Excel Format. Last updated at Dec. 3, 2018 by Teachoo. Form no. Description GSTR 1 How to file nil amount return of GSTR1 GST Return E-filing Training Form no. Description GSTR 1A Auto Drafted Details Download GSTR 1A in PDF Format Form GSTR-1A.pdf Who is required to file GST Annual return. Every registered person, other than an Input Service Distributor, a person paying tax under section 51 of CGST Act 2017 or section 52 of CGST Act 2017, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and

2 1. FURNISHING OF RETURNS 1.1 File A Return (GST - 03) - For Taxpayers Who Have Accounting Software 1. Login ID (email address). 2. Password (specified during registration). 7/08/2017 · GST RETURN 3B FILING for July and August File your GSTR 3B before 20 Aug &20 Sep Online Live Demo Form GSTR-3B needs to be filed by a taxable person under GST for …

Who is required to file GST Annual return. Every registered person, other than an Input Service Distributor, a person paying tax under section 51 of CGST Act 2017 or section 52 of CGST Act 2017, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and GST Return Formats 2018 (Updated), Download GST Return Forms (GSTR Forms). Download GST Return Filing Formats in PDF Format. Download Goods and Service Tax Return Formats.

GST RETURN 3B FILING for July and August youtube.com. Filing your GST return with us Find out about submitting your GST return and making GST payments to us and learn how to avoid interests and penalties. Learn about, GST returns basics - GST All updated online CA CS CMA classes in Streaming,Pendrive and App with Download for May and Nov 19 batch..

How to File GSTR-3B (Guide to Filing of Form 3B) GST

How to Submit / File GST Returns on the GST Website. 1. Introduction. Form 3B is a return form in lieu of FORM GSTR-3 and thus, is to be filed by only those persons who are liable to file Form 3 viz., persons other than Compositions dealers, or an Input Service Distributor or a non-resident taxable person or a person responsible for deducting or colleting tax at source under section 51 or section, Form GSTR-1 Return Filing, Format and Due Date The Goods and Service Tax Council in its meeting on 3rd and 4th July had shared a revised format for returns which needs to be filed under the GST ….

Prepare your GST return (New Zealand only) MYOB. Partnership tax return 2018. The Partnership tax return 2018 (NAT 0659-6.2018) is available in Portable Document Format (PDF). Next steps: Download a PDF of the Partnership tax return 2018 (PDF, 323KB) This link will download a file, Who is required to file GST Annual return. Every registered person, other than an Input Service Distributor, a person paying tax under section 51 of CGST Act 2017 or section 52 of CGST Act 2017, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and.

How to file GSTR 1 a step by step guide Tally Solutions

GST Return Filing Procedure How to File GST Returns Online. Other than the monthly returns, they are also required to file one annual return. In this guide, you will learn about the most common annual return form under GST, also known as GSTR 9. What is the annual return under GST? It is a GST return to be filed by the taxpayers annually. It gives the government a detailed picture of t... Here we provide all the updated GST form including final GST rules, rules related to the registration and amendments, GST forms related to the returns/statements, invoice formats and transition and migration-related GST forms..

GST monthly return filing is a little complex task as matching and reversal task are also involved under GST return filing procedure. If there is any discrepancy in filing between seller and buyer, then the same has to be reconciled. Let us understand the full procedure: facilitate uploading invoices as well as filing returns & act as a single stop shop for GST related services. Currently there are 34 approved GSPs (including companies like Tally, TCS,

Filing your GST return with us Find out about submitting your GST return and making GST payments to us and learn how to avoid interests and penalties. Learn about GST Return Formats 2018 (Updated), Download GST Return Forms (GSTR Forms). Download GST Return Filing Formats in PDF Format. Download Goods and Service Tax Return Formats.

Filing Process of GST Annual Return GSTR 9 (GSTR-9, 9A & 9C): All companies (private limited company, one person company, limited company, section 8 company, etc) are required to file an annual return with the MCA every year. In your online company file, go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears. In the File Online tab, click Prepare GST Return and a browser window will appear.

24/07/2017В В· 31st GST Council Meeting Updates| Simple GST Returns| Late fee waived off| Easy Refund procedure - Duration: 19:33. Tax without Tears 25,418 views It is very much easy to prepare GST returns in Tally.ERP 9 (simply Tally) because you do not have to actually prepare the returns. You just have to create Sales and Purchase bills and the returns will be created automatically .

Form GSTR-2 Return Filing, Format and Due Date In our previous article we discussed the revised heads, new formats and return filing procedure of the GSTR-1 FORM which should be filed by the taxpayer for his outward supplies made. Presently, the draft business processes on GST returns, GST registration, GST refunds and GST payments are being published. The Report of the Committee on GST Returns is available here . Comments and views are invited on these business processes by 6th November, 2015 .

It is very much easy to prepare GST returns in Tally.ERP 9 (simply Tally) because you do not have to actually prepare the returns. You just have to create Sales and Purchase bills and the returns will be created automatically . Under GST, returns are required to be filled every month. Return Purpose of Return Due Date of filing return GSTR 1 Outward Supplies of every month requires to be reported like Sale Stock transfer to other branch Export Any other movement of goods 10th of every next month* Illustration For the month of April, return requires to be file on or before 10th May GSTR 2 Inward Supplies of every

1. Introduction. Form 3B is a return form in lieu of FORM GSTR-3 and thus, is to be filed by only those persons who are liable to file Form 3 viz., persons other than Compositions dealers, or an Input Service Distributor or a non-resident taxable person or a person responsible for deducting or colleting tax at source under section 51 or section Get more details for How to File GST Return online, Every registered taxable person has to furnish outward supply details in Form GSTR-1 by the 10th of the subsequent month. . here you may download GST Return Formats in Excel and PDF Format, This document lists out the salient aspects of the process related to filing of Returns under GST.

Completing GST Return. General tips and instructions on completing your GST F5 Return are listed below. Jump To . Select Subheading. Before Filing Your GST F5 Return; Before Filing Your GST F5 Return. The form GST F5 Return has thirteen boxes that you must fill. You can access your GST returns by logging in to myTax Portal. All figures reported in the GST Return must be in Singapore … ClearTax GST www.cleartax.com/GST gstsupport@cleartax.in 080-67458707 Who needs to file GSTR 3B Every person registered under GST

Filing your GST return with us Find out about submitting your GST return and making GST payments to us and learn how to avoid interests and penalties. Learn about Form GSTR-2 Return Filing, Format and Due Date In our previous article we discussed the revised heads, new formats and return filing procedure of the GSTR-1 FORM which should be filed by the taxpayer for his outward supplies made.

2 1. FURNISHING OF RETURNS 1.1 File A Return (GST - 03) - For Taxpayers Who Have Accounting Software 1. Login ID (email address). 2. Password (specified during registration). In your online company file, go to the Accounts command centre and click Prepare GST Return. The Prepare GST Return window appears. In the File Online tab, click Prepare GST Return and a browser window will appear.

Presently, the draft business processes on GST returns, GST registration, GST refunds and GST payments are being published. The Report of the Committee on GST Returns is available here . Comments and views are invited on these business processes by 6th November, 2015 . 1. Introduction. Form 3B is a return form in lieu of FORM GSTR-3 and thus, is to be filed by only those persons who are liable to file Form 3 viz., persons other than Compositions dealers, or an Input Service Distributor or a non-resident taxable person or a person responsible for deducting or colleting tax at source under section 51 or section

Master PDF Editor is a PDF editor application that allows you to create, edit, preview, encrypt, sign and print PDF documents. It’s editing features allow you to convert between PDF and XPS formats, add interactive controls such as buttons, text fields, check boxes, and event handlers to your documents, split and merge PDF files. Master pdf editor free download Dubuc Master PDF Editor 5.0.36 Multilingual File size: 30.4 MB Our robust and rich set of features includes the full support of PDF and XPS files, import/export PDF pages into JPG, TIFF, PNG, or BMP formats, converting XPS into PDF and vice versa, and 128 bit encryption.