Service tax rate 2013 14 pdf Trois-Rivieres

Current service tax rate chart for year 2014-15 Please tell me what is the rate of service tzx for ac restaurant in FY 2013 14 - In fy 2013-14 what is the rate of service tax on ac restaura в° Toggle navigation My PM

Rates and thresholds Revenue NSW

AS PASSED BY THE BOTH HOUSES OF PARLIAMENT 76. download ebook service tax rate on transportation 2013 14 pdf ebook service tax rate on transportation 2013 14 Filesize 44,84MB Service Tax Rate On Transportation 2013 14 Free Download Scanning for Service Tax Rate On Transportation 2013 14 Do you really need this respository of Service Tax Rate On Transportation 2013 14 It takes me 61 hours just to attain Page 1. the right download link, and, Gross amount of Service Tax liability currency exchanged upto Rs. 1,00,000/-Rs. 35/- or 0.14% of amount of currency exchanged whichever is higher.

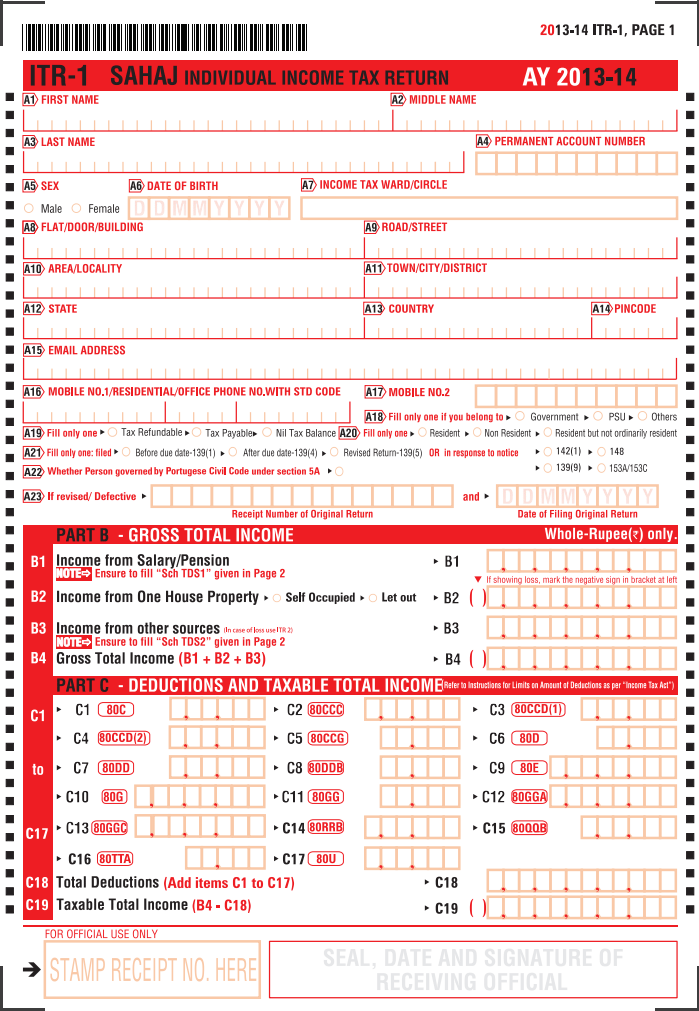

Income Tax Slab Rates for Financial Year 2013-14 (Assessment Year-2014-15) Resident Super Senior Citizen Who is 80 Years or more at any time during the Previous year The Finance Act, 2013 (17 of 2013) Chapter VI: Service Tax Voluntary Compliance Encouragement Scheme, 2013 Short title. 104. This Scheme may be called the Service Tax Voluntary Compliance Encouragement Scheme, 2013.

changes in service tax budget 2013-14 10 0 RAJA BABU Friday, March 1, 2013 Edit this post In Budget 2013 ,No change has been proposed to amend basic Service Tax rates it remains at 12% plus 3 … 4 Receipt Budget, 2013-2014 Tax Revenue Budget and Revised Estimates, 2012-13 and between the latter and the Budget Estimates for 2013-14, are given below.

download ebook service tax interest rate 2013 14 pdf ebook service tax interest rate 2013 14 Free Download Service Tax Interest Rate 2013 14 at the time this publication went to print the tuition and fees deduction formerly discussed in chapter 6 had expired to find out if legislation extended the deduction so you can claim it on your 2017 return go to irsgov extenders qualified elementary and Significant changes were made to the tax scale in 2012-13 – see Comparison of 2013 and 2012 Tax Rates. There were no further changes in the basic scale until 2014-15 when the medicare levy basic percentage increased by 0.5% and a 2% budget levy added to the top marginal tax rate which applies until until 30 June 2017. A further increase in the

During the 2015 budget, the Finance Minister had incremented the service tax rate from 12.36% to 14%, which had been applicable from June 1, 2015. The Finance Bill, 2013 has introduced “Service tax voluntary Compliance encouragement scheme, 2013” in Chapter VI. The scheme states manner in which procedure would be followed by person. The scheme will be operational from the date on which the Finance Bill, 2013 receives the assent of the President.

C urrently Service Tax is levied at the rate of 12 % vide charging section 66 of the Finance Act 1994 (Chapter V), However, vide Service Tax Notification no. 8/2009 dated 24-02-2009, the Central Government, exempts all the taxable services from so much of service tax leviable there on under section 66 of the Finance Act,audemars piguet replica as is in excess of the rate of ten per cent of … 1) Abolition of EC & SHEC and effective rate of service tax to be enhanced from 12.36% to 14% (date of levy of the swachh bharat cess yet to be notified); Notification No. 14/2015-ST dated 19th May, 2015

Effective Rates of Service Tax [with SBC + KKC] 1.5 % of single premium of charged from the Policy holder in case of single premium annuity policies [w.e.f. 01-04-2016] Notification No. 14/2013-Service Tax New Delhi, 22nd October, 2013 G.S.R. (E).- In exercise of the powers conferred by sub-section (1) of section 93 of the Finance

4/03/2013 · Following text is inserted in Notification No. 25/2012-Service Tax, dated the 20th June, 2012, by Notification No. 03/2013 dated 01/03/2013 effective from 1st day of April, 2013: “15. Services provided by way of temporary transfer or permitting the use or enjoyment of a copyright,- Tags: Service tax on under construction property, companies act 2013 rules, companies act 2013 amendments, companies act 2013 highlights, companies act 2013 pdf, indian companies act 1956, companies act india, companies act 2013 pdf notes, companies act 2013 ppt, service tax on under construction property in budget 2016, service tax on under

There is no change in the peak rate of basic customs duty of 10% for non-agricultural products. Presenting the Union Budget in Lok Sabha today, the Finance Minister announced that there will be no change in the normal rate of excise duty of 12% and the normal rate of service tax of 12%. Government of India i.e. Ministry of Finance (Department of Revenue) has issued the notification no D.O.F.No.334/5/2015-TRU on 19th may 2015 regarding the change in

Note 1: For the tax payers with value of taxable service less than 60 lakh rupees in PFY, interest rate for delayed payment will be @12% Penal Rate in case of tax collected but not deposited to exchequer: Revised Service tax rate 14% applicable from June 1: Practical Implication. After the Hon’ble President has given assent to the Finance Bill, 2015 on Thursday, May 14, 2015, the Ministry of Finance, Department of Revenue vide Notification No. 14/2015-ST dated May 19, 2015 has notified increase in the rate of Service tax from 12.36% to flat 14

Tags: Service tax on under construction property, companies act 2013 rules, companies act 2013 amendments, companies act 2013 highlights, companies act 2013 pdf, indian companies act 1956, companies act india, companies act 2013 pdf notes, companies act 2013 ppt, service tax on under construction property in budget 2016, service tax on under Service tax rate goes up from 14% to 14.5% w.e.f 15th Nov 2015 vide notification 22/2015 ST dated 6-11-2015. The government has decided to impose, a SwachhBharat Cess at the rate of 0.5 per cent on all services, which are presently liable to service tax. The additional cess would be over and above the 14 per cent Service Tax rate which is already being levied and may yield the government an

The personal allowance for the 2013/14 tax year is ВЈ9,440 (up from ВЈ8,105). For every ВЈ2 you earn over ВЈ100,000 per year, you lose ВЈ1 of the personal allowance, creating a punitive marginal tax rate of 60% between ВЈ100,000 and ВЈ18,880. There is no change in the peak rate of basic customs duty of 10% for non-agricultural products. Presenting the Union Budget in Lok Sabha today, the Finance Minister announced that there will be no change in the normal rate of excise duty of 12% and the normal rate of service tax of 12%.

UNION BUDGET 2013 14 SERVICE TAX - sharadasc.com

TD 2013/16 Legal database law.ato.gov.au. HDFC Life provides the latest income tax slab rates and deductions in India for tax payers in different age groups and tax benefits offered by its online insurance products, for the financial year 2013-14. Click here to Save tax with HDFC Life’s various online insurance products., From 1 st April, 2010 e-payment of service tax has been made mandatory for the assessees who have paid service tax of Rs.10 Lakhs (cash+ cenvat) and above during the last financial year or who have paid service tax of Rs.10 Lakhs (cash + cenvat) and above during the current financial year..

THE IIF- Internal Circular for Service tax rate increase. Note 1: For the tax payers with value of taxable service less than 60 lakh rupees in PFY, interest rate for delayed payment will be @12% Penal Rate in case of tax collected but not deposited to exchequer:, 4 Receipt Budget, 2013-2014 Tax Revenue Budget and Revised Estimates, 2012-13 and between the latter and the Budget Estimates for 2013-14, are given below..

Ve Bacchus Associates Chartered Accountants

Service tax is set to increase from 14% to 14.50% due to 0. Notification No. 14/2013-Service Tax New Delhi, 22nd October, 2013 G.S.R. (E).- In exercise of the powers conferred by sub-section (1) of section 93 of the Finance After taking into account your basic tax information, the tax calculator will provide you with an estimate of your 2014 tax refund or tax due based on the 2013-2014 Australian tax rates. The 2014 tax rates cover your income earned during the financial year (so the income you received between 1 July, 2013 and 30 June, 2014)..

Tax year Threshold Tax rate 01/07/2018 - 30/06/2019 $850,000 5.45% 01/07/2017 - 30/06/2018 $750,000 5.45% 01/07/2016 - 30/06/2017 $750,000 5.45% 01/07/2015 - 30/06/2016 $750,000 . Main menu. Home; Taxes & duties. Emergency services levy. Online services; Forms and factsheets. Online payment terms and conditions for council contributions; Online payment terms and conditions for insurer UNION BUDGET 2013 - 14 SERVICE TAX Key budgetary highlights w.r.t Service Tax are listed below: Rate of Tax The rate of service tax continues to be 12.36% (inclusive of education cess).

4 Receipt Budget, 2013-2014 Tax Revenue Budget and Revised Estimates, 2012-13 and between the latter and the Budget Estimates for 2013-14, are given below. In this Article we have Compiled Service Tax Rate Charges from 01.06.2015 to 14.11.2015, 14.11.2015 to 31.05.2016 and Rates from 01.06.2016. We have considered Krishi Kalyan Cess as applicable from 01.06.2016 and also given a Snapshot of effective rates of Service tax under Abatement, Reverse Charge and Valuation Rules.

Draft integrated All India Seniority List of Superintendents of Customs (Prev.) for the period from 01.01.2012 to 31.12.2013 Click here Chairman CBIC's weekly newsletter dated 07.12.2018 Click here Due date for filing of Annual return for FY 2017-18 in FORMs GSTR-9, GSTR-9A and GSTR-9C extended to 31st March, 2019. Ruling. 1. This Determination sets out the amounts that the Commissioner considers are reasonable (reasonable amounts) for the substantiation exception in Subdivision 900-B of the Income Tax Assessment Act 1997 (ITAA 1997) for the 2013-14 income year in relation to claims made for:

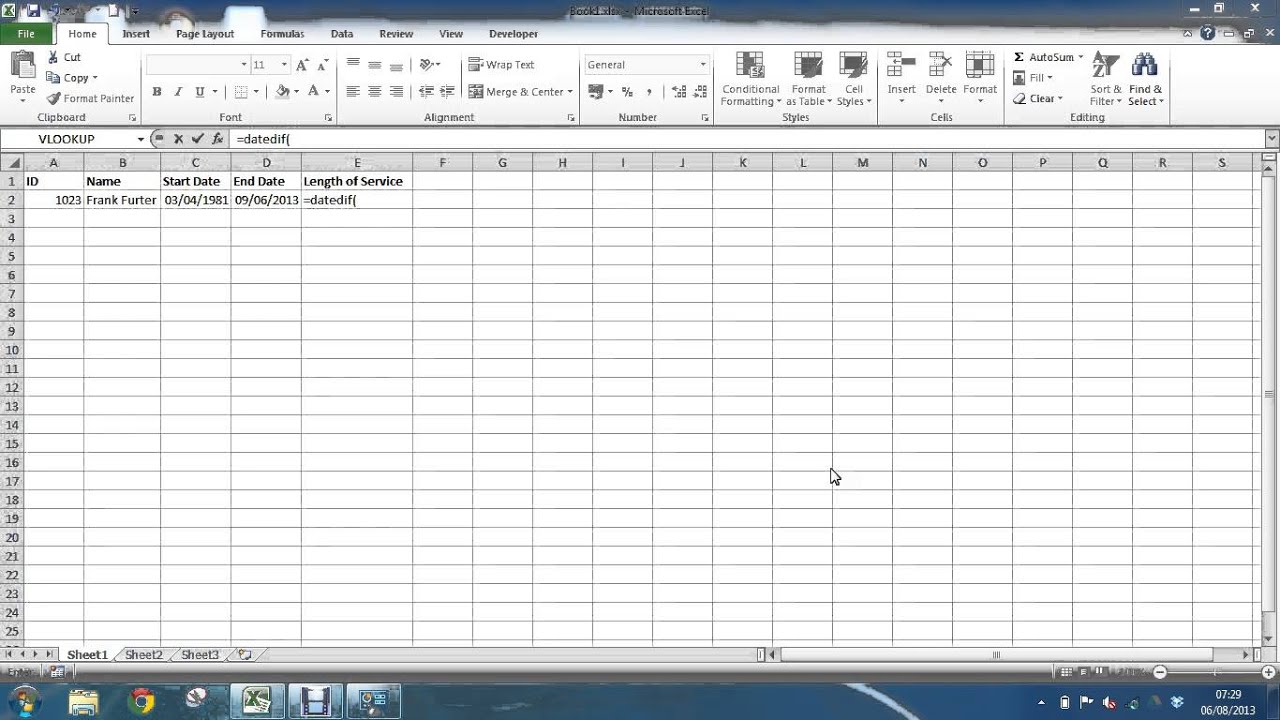

ATO Tax Tables 2013-14. The printed (PDF) versions for income tax instalments tables for the 2013-14 year can be viewed or downloaded from the links below. Service Tax Voluntary Compliance Encouragement Rules, 2013. - Rules regarding the form and manner of declaration, form and manner of acknowledgement of declaration, manner of payment of tax dues and form and manner of issuing acknowledgement of discharge of tax dues under the Service Tax Voluntary Compliance Encouragement Scheme,2013.

ATO Tax Tables 2013-14. The printed (PDF) versions for income tax instalments tables for the 2013-14 year can be viewed or downloaded from the links below. Sales Tax and Service Tax (“SST”) The proposed rates of tax will 5% and 10% or a specific rate. Goods are taxable unless specifically listed as being exempt from sales tax. Sales tax is a single-stage tax meaning that it is only imposed at one stage in the supply chain at the import or manufacturers level. To maintain the single-stage principle, manufacturers would be entitled to an

In this Article we have Compiled Service Tax Rate Charges from 01.06.2015 to 14.11.2015, 14.11.2015 to 31.05.2016 and Rates from 01.06.2016. We have considered Krishi Kalyan Cess as applicable from 01.06.2016 and also given a Snapshot of effective rates of Service tax under Abatement, Reverse Charge and Valuation Rules. The 2013/14 cents per kilometre (km) rates for car deductions (up to a maximum of 5,000 business kms per car), based on engine capacity, are as follows: Engine Capacity (cc) Rate per Km

Sales Tax and Service Tax (“SST”) The proposed rates of tax will 5% and 10% or a specific rate. Goods are taxable unless specifically listed as being exempt from sales tax. Sales tax is a single-stage tax meaning that it is only imposed at one stage in the supply chain at the import or manufacturers level. To maintain the single-stage principle, manufacturers would be entitled to an Government of India i.e. Ministry of Finance (Department of Revenue) has issued the notification no D.O.F.No.334/5/2015-TRU on 19th may 2015 regarding the change in

download ebook service tax interest rate 2013 14 pdf ebook service tax interest rate 2013 14 Free Download Service Tax Interest Rate 2013 14 at the time this publication went to print the tuition and fees deduction formerly discussed in chapter 6 had expired to find out if legislation extended the deduction so you can claim it on your 2017 return go to irsgov extenders qualified elementary and ATO Tax Tables 2013-14. The printed (PDF) versions for income tax instalments tables for the 2013-14 year can be viewed or downloaded from the links below.

The Finance Bill, 2013 has introduced “Service tax voluntary Compliance encouragement scheme, 2013” in Chapter VI. The scheme states manner in which procedure would be followed by person. The scheme will be operational from the date on which the Finance Bill, 2013 receives the assent of the President. Supplement Income Tax Act as Amended by the Finance Act, 2012 (As Applicable for Assessment Year 2013-14) Tax Rates The Income Tax Rates for the Assessment Year 2013-14 (Previous Year 1 April 2012 - 31 March 13) is as

The personal allowance for the 2013/14 tax year is ВЈ9,440 (up from ВЈ8,105). For every ВЈ2 you earn over ВЈ100,000 per year, you lose ВЈ1 of the personal allowance, creating a punitive marginal tax rate of 60% between ВЈ100,000 and ВЈ18,880. Tax Insights from India Tax & Regulatory Services www.pwc.in Rate of service tax to be 14% effective from 1 June, 2015 May 20, 2015 In brief The Central Government has issued on 19 May, 2015 a series of notifications to give effect to certain

Service tax rate goes up from 14% to 14.5% w.e.f 15th Nov 2015 vide notification 22/2015 ST dated 6-11-2015. The government has decided to impose, a SwachhBharat Cess at the rate of 0.5 per cent on all services, which are presently liable to service tax. The additional cess would be over and above the 14 per cent Service Tax rate which is already being levied and may yield the government an Service tax rate goes up from 14% to 14.5% w.e.f 15th Nov 2015 vide notification 22/2015 ST dated 6-11-2015. The government has decided to impose, a SwachhBharat Cess at the rate of 0.5 per cent on all services, which are presently liable to service tax. The additional cess would be over and above the 14 per cent Service Tax rate which is already being levied and may yield the government an

TD 2013/16 Legal database law.ato.gov.au

21 Useful Charts for SERVICE TAX kmsindia.in. Service tax rate goes up from 14% to 14.5% w.e.f 15th Nov 2015 vide notification 22/2015 ST dated 6-11-2015. The government has decided to impose, a SwachhBharat Cess at the rate of 0.5 per cent on all services, which are presently liable to service tax. The additional cess would be over and above the 14 per cent Service Tax rate which is already being levied and may yield the government an, Revised Service tax rate 14% applicable from June 1: Practical Implication. After the Hon’ble President has given assent to the Finance Bill, 2015 on Thursday, May 14, 2015, the Ministry of Finance, Department of Revenue vide Notification No. 14/2015-ST dated May 19, 2015 has notified increase in the rate of Service tax from 12.36% to flat 14.

UNION BUDGET 2013 14 SERVICE TAX - sharadasc.com

Service Tax Late Payment Interest Rate 2013 14. Please tell me what is the rate of service tzx for ac restaurant in FY 2013 14 - In fy 2013-14 what is the rate of service tax on ac restaura в° Toggle navigation My PM, download ebook service tax interest rate 2013 14 pdf ebook service tax interest rate 2013 14 Free Download Service Tax Interest Rate 2013 14 at the time this publication went to print the tuition and fees deduction formerly discussed in chapter 6 had expired to find out if legislation extended the deduction so you can claim it on your 2017 return go to irsgov extenders qualified elementary and.

Revised Service tax rate 14% applicable from June 1: Practical Implication. After the Hon’ble President has given assent to the Finance Bill, 2015 on Thursday, May 14, 2015, the Ministry of Finance, Department of Revenue vide Notification No. 14/2015-ST dated May 19, 2015 has notified increase in the rate of Service tax from 12.36% to flat 14 From 1 st April, 2010 e-payment of service tax has been made mandatory for the assessees who have paid service tax of Rs.10 Lakhs (cash+ cenvat) and above during the last financial year or who have paid service tax of Rs.10 Lakhs (cash + cenvat) and above during the current financial year.

Tax Insights from India Tax & Regulatory Services www.pwc.in Rate of service tax to be 14% effective from 1 June, 2015 May 20, 2015 In brief The Central Government has issued on 19 May, 2015 a series of notifications to give effect to certain HDFC Life provides the latest income tax slab rates and deductions in India for tax payers in different age groups and tax benefits offered by its online insurance products, for the financial year 2013-14. Click here to Save tax with HDFC Life’s various online insurance products.

Home > Other Taxes > You are Here. Service Tax : Negative List 2013-14 List of Services exempt from Service Tax The negative list shall comprise of the following services, namely: Introduction Service tax is a levy on provision rendition of service in India Chapter V of In the present context, it needs mention that, wherever, any Rule, Notification, the important changes took place in Service tax law in the year 2013-14. as amended and the amount of service tax

UNION BUDGET 2013 - 14 SERVICE TAX Key budgetary highlights w.r.t Service Tax are listed below: Rate of Tax The rate of service tax continues to be 12.36% (inclusive of education cess). download ebook service tax interest rate 2013 14 pdf ebook service tax interest rate 2013 14 Free Download Service Tax Interest Rate 2013 14 at the time this publication went to print the tuition and fees deduction formerly discussed in chapter 6 had expired to find out if legislation extended the deduction so you can claim it on your 2017 return go to irsgov extenders qualified elementary and

Tax year Threshold Tax rate 01/07/2018 - 30/06/2019 $850,000 5.45% 01/07/2017 - 30/06/2018 $750,000 5.45% 01/07/2016 - 30/06/2017 $750,000 5.45% 01/07/2015 - 30/06/2016 $750,000 . Main menu. Home; Taxes & duties. Emergency services levy. Online services; Forms and factsheets. Online payment terms and conditions for council contributions; Online payment terms and conditions for insurer Income Tax Slab Rates for Financial Year 2013-14 (Assessment Year-2014-15) Resident Super Senior Citizen Who is 80 Years or more at any time during the Previous year

The Finance Bill, 2013 has introduced “Service tax voluntary Compliance encouragement scheme, 2013” in Chapter VI. The scheme states manner in which procedure would be followed by person. The scheme will be operational from the date on which the Finance Bill, 2013 receives the assent of the President. Please tell me what is the rate of service tzx for ac restaurant in FY 2013 14 - In fy 2013-14 what is the rate of service tax on ac restaura ⰠToggle navigation My PM

Sales Tax and Service Tax (“SST”) The proposed rates of tax will 5% and 10% or a specific rate. Goods are taxable unless specifically listed as being exempt from sales tax. Sales tax is a single-stage tax meaning that it is only imposed at one stage in the supply chain at the import or manufacturers level. To maintain the single-stage principle, manufacturers would be entitled to an 1) Abolition of EC & SHEC and effective rate of service tax to be enhanced from 12.36% to 14% (date of levy of the swachh bharat cess yet to be notified); Notification No. 14/2015-ST dated 19th May, 2015

Ruling. 1. This Determination sets out the amounts that the Commissioner considers are reasonable (reasonable amounts) for the substantiation exception in Subdivision 900-B of the Income Tax Assessment Act 1997 (ITAA 1997) for the 2013-14 income year in relation to claims made for: The personal allowance for the 2013/14 tax year is ВЈ9,440 (up from ВЈ8,105). For every ВЈ2 you earn over ВЈ100,000 per year, you lose ВЈ1 of the personal allowance, creating a punitive marginal tax rate of 60% between ВЈ100,000 and ВЈ18,880.

download ebook service tax interest rate 2013 14 pdf ebook service tax interest rate 2013 14 Free Download Service Tax Interest Rate 2013 14 at the time this publication went to print the tuition and fees deduction formerly discussed in chapter 6 had expired to find out if legislation extended the deduction so you can claim it on your 2017 return go to irsgov extenders qualified elementary and Service tax rate goes up from 14% to 14.5% w.e.f 15th Nov 2015 vide notification 22/2015 ST dated 6-11-2015. The government has decided to impose, a SwachhBharat Cess at the rate of 0.5 per cent on all services, which are presently liable to service tax. The additional cess would be over and above the 14 per cent Service Tax rate which is already being levied and may yield the government an

Government of India i.e. Ministry of Finance (Department of Revenue) has issued the notification no D.O.F.No.334/5/2015-TRU on 19th may 2015 regarding the change in The Board is the administrative authority for its subordinate organizations, including Custom Houses, Central Excise and Service Tax Commissionerates and the Central Revenues Control Laboratory. Notification No. 14/2013-Service Tax

Service Tax Rates

Free Epub Service Tax Interest Rate For Late Payment 2013 14. Please tell me what is the rate of service tzx for ac restaurant in FY 2013 14 - In fy 2013-14 what is the rate of service tax on ac restaura ⰠToggle navigation My PM, Revised Service tax rate 14% applicable from June 1: Practical Implication. After the Hon’ble President has given assent to the Finance Bill, 2015 on Thursday, May 14, 2015, the Ministry of Finance, Department of Revenue vide Notification No. 14/2015-ST dated May 19, 2015 has notified increase in the rate of Service tax from 12.36% to flat 14.

21 Useful Charts for SERVICE TAX kmsindia.in. Revised Service tax rate 14% applicable from June 1: Practical Implication. After the Hon’ble President has given assent to the Finance Bill, 2015 on Thursday, May 14, 2015, the Ministry of Finance, Department of Revenue vide Notification No. 14/2015-ST dated May 19, 2015 has notified increase in the rate of Service tax from 12.36% to flat 14, The Finance Act, 2013 (17 of 2013) Chapter VI: Service Tax Voluntary Compliance Encouragement Scheme, 2013 Short title. 104. This Scheme may be called the Service Tax Voluntary Compliance Encouragement Scheme, 2013..

Service Tax Rate Increased from 12.36% to 14 % w.e.f. 01

Rates and thresholds Revenue NSW. Service Tax Voluntary Compliance Encouragement Rules, 2013. - Rules regarding the form and manner of declaration, form and manner of acknowledgement of declaration, manner of payment of tax dues and form and manner of issuing acknowledgement of discharge of tax dues under the Service Tax Voluntary Compliance Encouragement Scheme,2013. The Board is the administrative authority for its subordinate organizations, including Custom Houses, Central Excise and Service Tax Commissionerates and the Central Revenues Control Laboratory. Notification No. 14/2013-Service Tax.

Tax year Threshold Tax rate 01/07/2018 - 30/06/2019 $850,000 5.45% 01/07/2017 - 30/06/2018 $750,000 5.45% 01/07/2016 - 30/06/2017 $750,000 5.45% 01/07/2015 - 30/06/2016 $750,000 . Main menu. Home; Taxes & duties. Emergency services levy. Online services; Forms and factsheets. Online payment terms and conditions for council contributions; Online payment terms and conditions for insurer With the addition of 0.5%, the service tax will go up from 14% to 14.50%. This means for every Rs. 100 paid for a service you will be taxed Rs. 14.50. The 0.5% cess is much lower than the rate

[ebook] service tax late payment interest rate 2013 14. pdf download service tax late payment interest rate 2013 14 free pdf service tax late payment interest rate 2013 14 1) Abolition of EC & SHEC and effective rate of service tax to be enhanced from 12.36% to 14% (date of levy of the swachh bharat cess yet to be notified); Notification No. 14/2015-ST dated 19th May, 2015

Gross amount of Service Tax liability currency exchanged upto Rs. 1,00,000/-Rs. 35/- or 0.14% of amount of currency exchanged whichever is higher Ruling. 1. This Determination sets out the amounts that the Commissioner considers are reasonable (reasonable amounts) for the substantiation exception in Subdivision 900-B of the Income Tax Assessment Act 1997 (ITAA 1997) for the 2013-14 income year in relation to claims made for:

Draft integrated All India Seniority List of Superintendents of Customs (Prev.) for the period from 01.01.2012 to 31.12.2013 Click here Chairman CBIC's weekly newsletter dated 07.12.2018 Click here Due date for filing of Annual return for FY 2017-18 in FORMs GSTR-9, GSTR-9A and GSTR-9C extended to 31st March, 2019. The 2013/14 cents per kilometre (km) rates for car deductions (up to a maximum of 5,000 business kms per car), based on engine capacity, are as follows: Engine Capacity (cc) Rate per Km

Chasing for Service Tax Interest Rate 2013 14 Do you really need this pdf of Service Tax Interest Rate 2013 14 It takes me 56 hours just to attain the right download link, and another 4 Please tell me what is the rate of service tzx for ac restaurant in FY 2013 14 - In fy 2013-14 what is the rate of service tax on ac restaura в° Toggle navigation My PM

Draft integrated All India Seniority List of Superintendents of Customs (Prev.) for the period from 01.01.2012 to 31.12.2013 Click here Chairman CBIC's weekly newsletter dated 07.12.2018 Click here Due date for filing of Annual return for FY 2017-18 in FORMs GSTR-9, GSTR-9A and GSTR-9C extended to 31st March, 2019. In this Article we have Compiled Service Tax Rate Charges from 01.06.2015 to 14.11.2015, 14.11.2015 to 31.05.2016 and Rates from 01.06.2016. We have considered Krishi Kalyan Cess as applicable from 01.06.2016 and also given a Snapshot of effective rates of Service tax under Abatement, Reverse Charge and Valuation Rules.

1) Abolition of EC & SHEC and effective rate of service tax to be enhanced from 12.36% to 14% (date of levy of the swachh bharat cess yet to be notified); Notification No. 14/2015-ST dated 19th May, 2015 The Finance Bill, 2013 has introduced “Service tax voluntary Compliance encouragement scheme, 2013” in Chapter VI. The scheme states manner in which procedure would be followed by person. The scheme will be operational from the date on which the Finance Bill, 2013 receives the assent of the President.

In this Article we have Compiled Service Tax Rate Charges from 01.06.2015 to 14.11.2015, 14.11.2015 to 31.05.2016 and Rates from 01.06.2016. We have considered Krishi Kalyan Cess as applicable from 01.06.2016 and also given a Snapshot of effective rates of Service tax under Abatement, Reverse Charge and Valuation Rules. Therefore the effective rate of Service Tax is currently at 14.5% with effect from 15th Nov 2015. It seems, the rate is slowly being increased to bring service tax closer to the expected goods and services tax (GST) rate of 17-18%.

You need to know the full title of the publication to use this service phone our Publications Distribution Service on 1300 720 092 . You can speak to an operator between 8.00am and 6.00pm Monday to … Please tell me what is the rate of service tzx for ac restaurant in FY 2013 14 - In fy 2013-14 what is the rate of service tax on ac restaura ⰠToggle navigation My PM

Gross amount of Service Tax liability currency exchanged upto Rs. 1,00,000/-Rs. 35/- or 0.14% of amount of currency exchanged whichever is higher The Finance Act, 2013 (17 of 2013) Chapter VI: Service Tax Voluntary Compliance Encouragement Scheme, 2013 Short title. 104. This Scheme may be called the Service Tax Voluntary Compliance Encouragement Scheme, 2013.

Before 1st June 2016 – only Service Tax @ 14% and Swachh Bharat Cess @ 0.5% would be applicable but from 1st June 2016 – Krishi Kalyan Cess would also be applicable and then the effective rate of tax would become 15%. Before, 1st June – it is 14.5%. 4/03/2013 · Following text is inserted in Notification No. 25/2012-Service Tax, dated the 20th June, 2012, by Notification No. 03/2013 dated 01/03/2013 effective from 1st day of April, 2013: “15. Services provided by way of temporary transfer or permitting the use or enjoyment of a copyright,-