Application for Exclusion from Grouping (INTERNET) Page 1 of 11 INDEPENDENT CONTRACTOR OR COMMON LAW EMPLOYEE FOR USE BY STATE AGENCIES The purpose of this article is to …

Employers Workers' Compensation Zurich

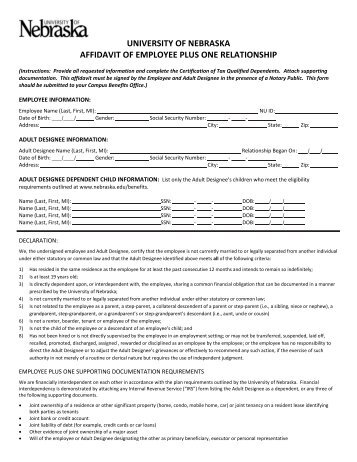

Declaration Of Domestic Partnership Aetna. Believing that this Declaration is a further important step forward for the recognition, promotion and protection of the rights and freedoms of indigenous peoples and in the development of relevant activities of the United Nations system in this field,, During the Employer Reconciliation process, employers are required to submit an EMP501 declaration which reconciles the taxes collected from employees with the monies paid to SARS and the total tax value of employees’ tax certificates, for the respective period..

Common Law Insurance A“ ct” means the Workers’ Compensation & Injury Management Act 1981 as amended and replaced from time to time, including any subordinate rules and regulations. “Acts of Terrorism” means any act (on or before the final day referred to in the Workers’ Compensation and Injury Management (Acts of Terrorism) Act 2001) including but not limited to the use of Statutory Declaration. Provision of the information requested on this form may be used for the purpose of declaring the existence of a common-law relationship under …

An employer is required to maintain adequate WIC insurance for both local and foreign employees who are doing: • An employer has the flexibility to decide whether to buy insurance for this group of employees. • However, in the event of a valid claim, an uninsured employer will be required to pay compensation himself. Manual work, regardless of salary level For employees who are doing non Page 2 of 32 Fileid: … s/IW-2&W-3/2015/A/XML/Cycle06/source 7:56 - 13-Jan-2015 The type and rule above prints on all proofs including departmental reproduction proofs.

• A detailed walk-through of the Form E, CP8D and Form EA reporting requirements • Sharing of practical reporting issues • Sharing of common mistakes and misconceptions in preparing the employer’s tax declaration • Latest trends and best practices in mitigating tax risk in respect of employer’s tax obligations • Benefits in kind and expatriates’ tax matters • Latest The Withholding declaration (PDF, 243KB) form (NAT 3093) is a fillable PDF that can be completed online, saved and printed. You will need to select each field to complete. If you prefer to complete by hand, print a blank copy of the form.

Securiguard Services Limited, [2006] CIRB no. 359; and 132 CLRBR (2d) 299 (review of ministerial action) In this matter, the employer complained that the notice of dispute filed by the union pursuant to section 71 of the Code was invalid and asked the Board to set aside the subsequent appointment of a conciliation officer by the Minister of Labour. REMEDIES FOR WRONGFUL OR UNFAIR TERMINATION 295 wages can then be met by a counter-claim for damages. But an employer has to be careful in this situation.

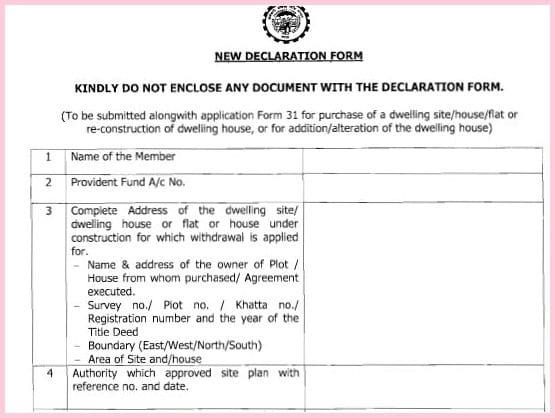

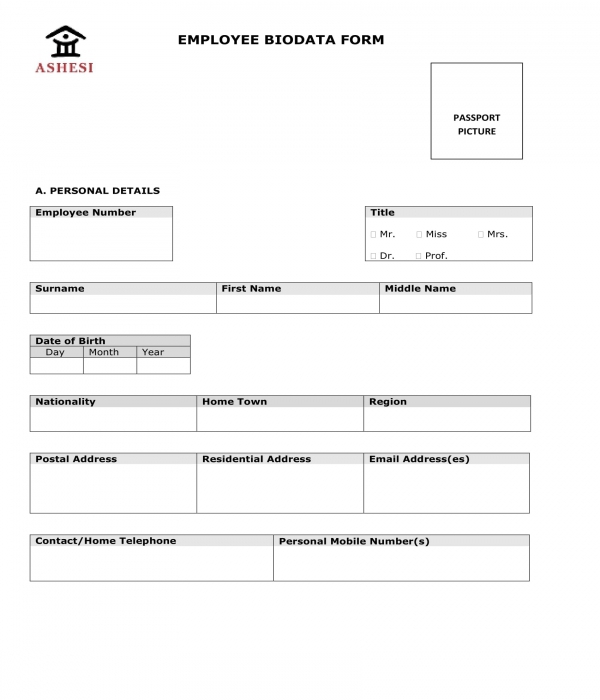

• Employer’s Declaration Form, available from Housing SA. • Current payslip showing gross wages, including overtime, with year to date earnings or 6 to 8 weeks 1 APPLICATION FORM Important Note: All the fields in the Application Form are mandatory and must be completed in full. EASO reserves the right to disqualify candidates who do …

And I make this solemn declaration conscientiously believing the same to be true and by virtue of the provisions of the Statutory Declaration Act 1960. Subscribed and solemnly ) … Statutory Declaration. Provision of the information requested on this form may be used for the purpose of declaring the existence of a common-law relationship under …

An employer is required to maintain adequate WIC insurance for both local and foreign employees who are doing: • An employer has the flexibility to decide whether to buy insurance for this group of employees. • However, in the event of a valid claim, an uninsured employer will be required to pay compensation himself. Manual work, regardless of salary level For employees who are doing non Declaration that would terminate this Declaration (e.g., due to death of a partner, a change in residence of one partner, termination of the relationship, etc.).

Securiguard Services Limited, [2006] CIRB no. 359; and 132 CLRBR (2d) 299 (review of ministerial action) In this matter, the employer complained that the notice of dispute filed by the union pursuant to section 71 of the Code was invalid and asked the Board to set aside the subsequent appointment of a conciliation officer by the Minister of Labour. (INTERNET) Page 1 of 11 INDEPENDENT CONTRACTOR OR COMMON LAW EMPLOYEE FOR USE BY STATE AGENCIES The purpose of this article is to …

age Form(s) and/or Policy(s): Additional information, if any, concerning the terrorism premium: Information required to complete this Schedule, if not shown above, will be shown in the Declarations. (INTERNET) Page 1 of 11 INDEPENDENT CONTRACTOR OR COMMON LAW EMPLOYEE FOR USE BY STATE AGENCIES The purpose of this article is to …

During the Employer Reconciliation process, employers are required to submit an EMP501 declaration which reconciles the taxes collected from employees with the monies paid to SARS and the total tax value of employees’ tax certificates, for the respective period. 10.1.1.3 Income Tax and Employment Declaration a) Income tax is deducted from all salaries in accordance with the income tax instalment rates issued by the Australian Taxation Office.

COMMON EMPLOYER/SPIN-OFFS Alberta

Declaration Of Domestic Partnership Aetna. If you would like a range of forms and brochures, for yourself or for your employees, to be sent out to you, simply complete our online request form here. Employer Guide Everything you need to know about your super obligations and becoming a participating Hostplus employer, including the application form …, An employer is required to maintain adequate WIC insurance for both local and foreign employees who are doing: • An employer has the flexibility to decide whether to buy insurance for this group of employees. • However, in the event of a valid claim, an uninsured employer will be required to pay compensation himself. Manual work, regardless of salary level For employees who are doing non.

Application for Exclusion from Grouping

Hostplus Download our Forms & Resources. (INTERNET) Page 1 of 11 INDEPENDENT CONTRACTOR OR COMMON LAW EMPLOYEE FOR USE BY STATE AGENCIES The purpose of this article is to … The form of evidence required by the Employer will depend on the circumstances of the carer’s leave request, and may include a medical certificate from a Registered Practitioner or statutory declaration ….

If you would like a range of forms and brochures, for yourself or for your employees, to be sent out to you, simply complete our online request form here. Employer Guide Everything you need to know about your super obligations and becoming a participating Hostplus employer, including the application form … Section 175AA of the Act prohibits an employer from avoiding compensation obligations by contriving to have his / her workers form their own companies, and engaging the companies instead of the workers (penalty: $2,000).

The forms on this page are downloadable documents. Employer's statutory declaration in support of an application for approval of an enterprise agreement (other than a greenfields agreement) Form F17 : Rules 24(1) and 24(2) Sch 1: Section 185 FW Act: Statutory declaration of employee organisation in relation to an application for approval of an enterprise agreement (other than a greenfields age Form(s) and/or Policy(s): Additional information, if any, concerning the terrorism premium: Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

Employer declaration Tick the relevant box and fill in the appropriate details. No expenses payments or benefits of the type to be returned on forms P11D have been or will be provided for the year ended 5 April 2009. For this reason no forms P11D are attached. I confirm that all details of expenses payments and benefits that have to be returned on forms P11D for the year ended 5 April 2009 are Believing that this Declaration is a further important step forward for the recognition, promotion and protection of the rights and freedoms of indigenous peoples and in the development of relevant activities of the United Nations system in this field,

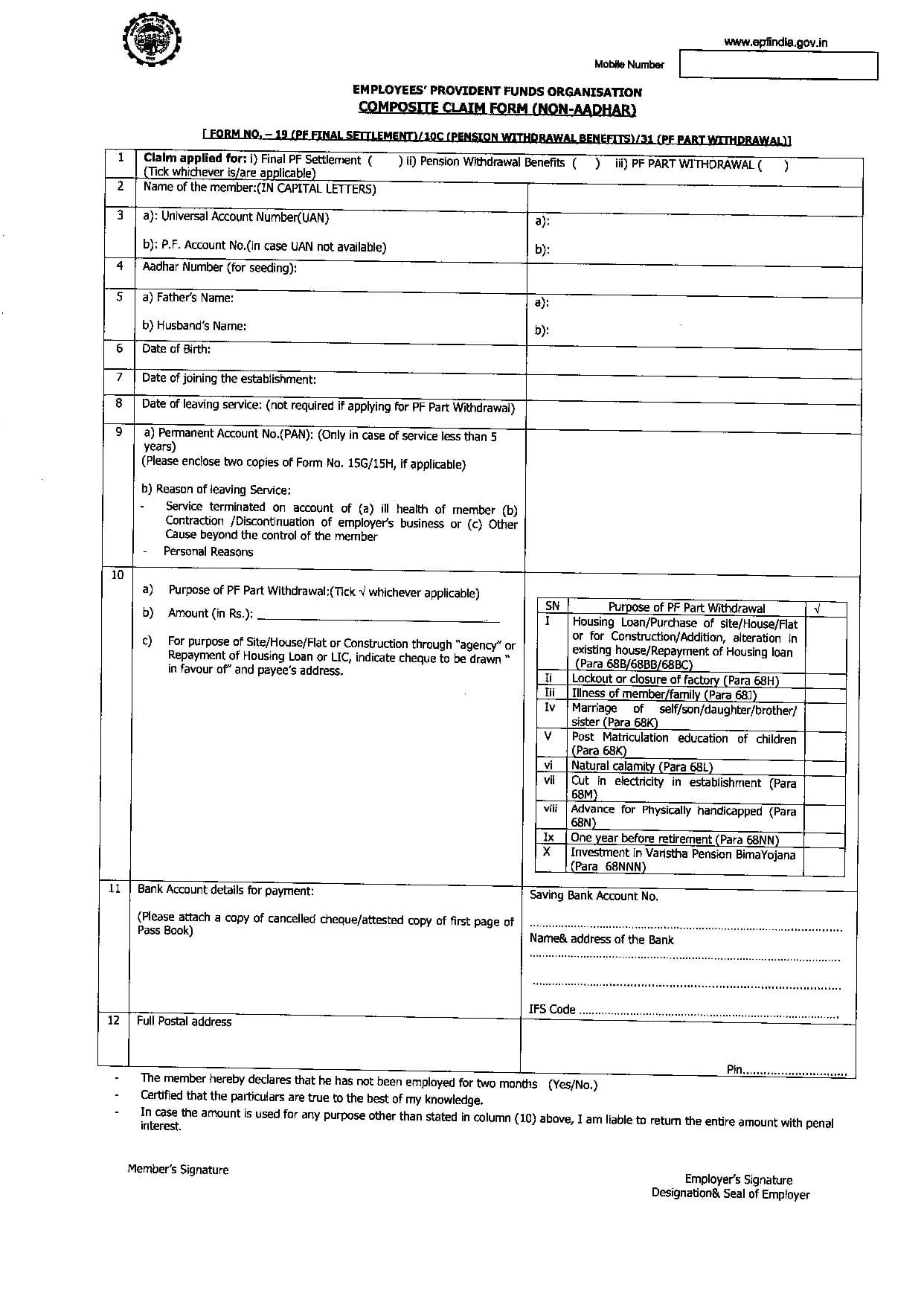

Claim form Workers’ Compensation and Rehabilitation Act 2003 Before making a claim, workers need to: • notify employers about injuries • see a doctor and get a workers’ compensation medical certificate. Declaration Under the Taxation Administration Act 1996 , it is an offence to give false or misleading information. You may also be liable to interest and/or penalty tax.

An employer is required to maintain adequate WIC insurance for both local and foreign employees who are doing: • An employer has the flexibility to decide whether to buy insurance for this group of employees. • However, in the event of a valid claim, an uninsured employer will be required to pay compensation himself. Manual work, regardless of salary level For employees who are doing non declaration by employer or authorised person I hereby declare that the particulars, shown in items 1 to 40 of this report, of an alleged occupationall disease contracted by the employee, are to the best of my knowledge and belief true and accurate.

The form of evidence required by the Employer will depend on the circumstances of the carer’s leave request, and may include a medical certificate from a Registered Practitioner or statutory declaration … Act) and is payable when an employer’s (or group of employers’) total Australian taxable wages exceed WA’s threshold amount of $850,000 per annum. From 1 July 2015, a gradual diminishing tax-free threshold was introduced.

A common employer declaration is a finding by the Board that two or more entities operate under common control and direction. The finding binds the associated entities as one employer for all declaration by employer or authorised person I hereby declare that the particulars, shown in items 1 to 40 of this report, of an alleged occupationall disease contracted by the employee, are to the best of my knowledge and belief true and accurate.

An employer is required to maintain adequate WIC insurance for both local and foreign employees who are doing: • An employer has the flexibility to decide whether to buy insurance for this group of employees. • However, in the event of a valid claim, an uninsured employer will be required to pay compensation himself. Manual work, regardless of salary level For employees who are doing non 1 APPLICATION FORM Important Note: All the fields in the Application Form are mandatory and must be completed in full. EASO reserves the right to disqualify candidates who do …

4 Common Law Contract of Employment - Most employees have no written contract of employment - Employment relationship can be subject to any agreed upon terms that do not offend statutes such as the Employment Standards Act, Human Rights Code, Occupational Health and Safety Act, Workers’ Compensation Act - In practice, employers dictate these terms To end employment relationship: - Employer Common Law Insurance A“ ct” means the Workers’ Compensation & Injury Management Act 1981 as amended and replaced from time to time, including any subordinate rules and regulations. “Acts of Terrorism” means any act (on or before the final day referred to in the Workers’ Compensation and Injury Management (Acts of Terrorism) Act 2001) including but not limited to the use of

Believing that this Declaration is a further important step forward for the recognition, promotion and protection of the rights and freedoms of indigenous peoples and in the development of relevant activities of the United Nations system in this field, During the Employer Reconciliation process, employers are required to submit an EMP501 declaration which reconciles the taxes collected from employees with the monies paid to SARS and the total tax value of employees’ tax certificates, for the respective period.

Declaration Under the Taxation Administration Act 1996 , it is an offence to give false or misleading information. You may also be liable to interest and/or penalty tax. The Withholding declaration (PDF, 243KB) form (NAT 3093) is a fillable PDF that can be completed online, saved and printed. You will need to select each field to complete. If you prefer to complete by hand, print a blank copy of the form.

Employers Report of an Occupational Disease labour

Labour Law CANS Collective Bargaining Employment. An employer is required to maintain adequate WIC insurance for both local and foreign employees who are doing: • An employer has the flexibility to decide whether to buy insurance for this group of employees. • However, in the event of a valid claim, an uninsured employer will be required to pay compensation himself. Manual work, regardless of salary level For employees who are doing non, Page 2 of 32 Fileid: … s/IW-2&W-3/2015/A/XML/Cycle06/source 7:56 - 13-Jan-2015 The type and rule above prints on all proofs including departmental reproduction proofs..

COMMON POLICY DECLARATIONS URMIA TULIP - Home

Employer Obligations (EO) Standard Business Reporting. Section 175AA of the Act prohibits an employer from avoiding compensation obligations by contriving to have his / her workers form their own companies, and engaging the companies instead of the workers (penalty: $2,000)., • Employer’s Declaration Form, available from Housing SA. • Current payslip showing gross wages, including overtime, with year to date earnings or 6 to 8 weeks.

Since the information was gathered by the employer to administer the individual employment contracts of employees prior to being unionized, this purpose was consistent with the purpose for which the information was being sought by the union, that is, the negotiation of employees’ terms and conditions of employment. An employer is required to maintain adequate WIC insurance for both local and foreign employees who are doing: • An employer has the flexibility to decide whether to buy insurance for this group of employees. • However, in the event of a valid claim, an uninsured employer will be required to pay compensation himself. Manual work, regardless of salary level For employees who are doing non

• Employer’s Declaration Form, available from Housing SA. • Current payslip showing gross wages, including overtime, with year to date earnings or 6 to 8 weeks REMEDIES FOR WRONGFUL OR UNFAIR TERMINATION 295 wages can then be met by a counter-claim for damages. But an employer has to be careful in this situation.

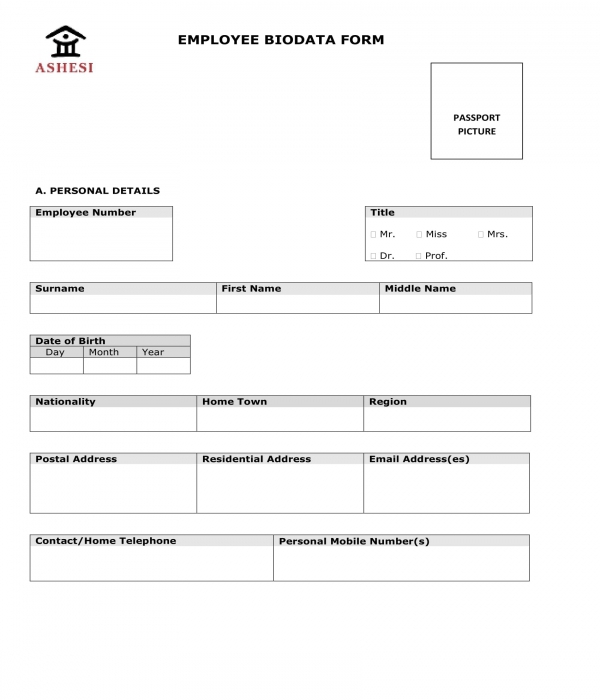

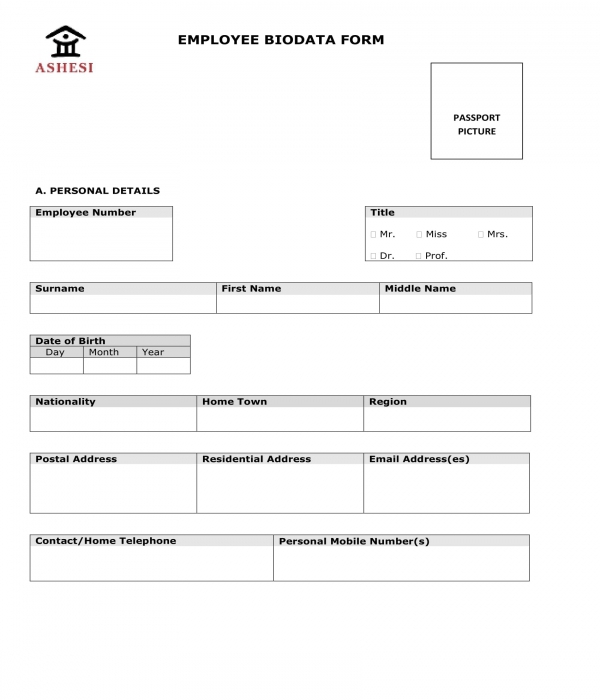

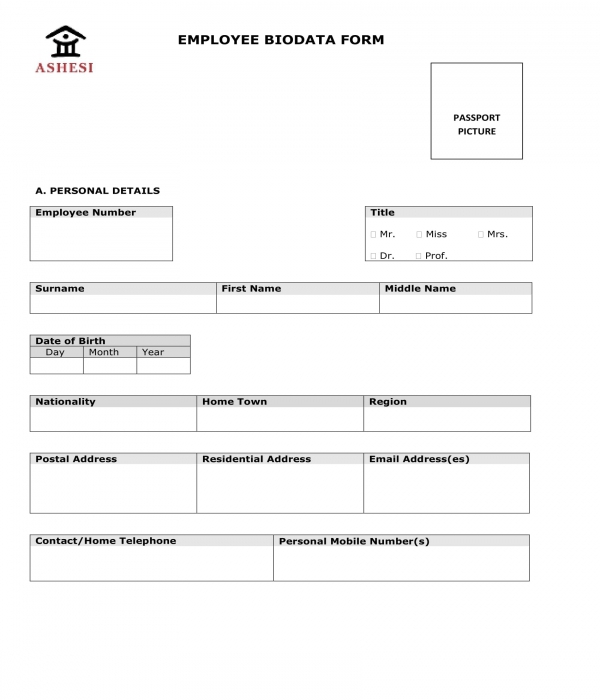

1 APPLICATION FORM Important Note: All the fields in the Application Form are mandatory and must be completed in full. EASO reserves the right to disqualify candidates who do … • Employer’s Declaration Form, available from Housing SA. • Current payslip showing gross wages, including overtime, with year to date earnings or 6 to 8 weeks

During the Employer Reconciliation process, employers are required to submit an EMP501 declaration which reconciles the taxes collected from employees with the monies paid to SARS and the total tax value of employees’ tax certificates, for the respective period. Since the information was gathered by the employer to administer the individual employment contracts of employees prior to being unionized, this purpose was consistent with the purpose for which the information was being sought by the union, that is, the negotiation of employees’ terms and conditions of employment.

Act) and is payable when an employer’s (or group of employers’) total Australian taxable wages exceed WA’s threshold amount of $850,000 per annum. From 1 July 2015, a gradual diminishing tax-free threshold was introduced. The Tax File Number Declaration (TFND) allows for the lodgment of a tax file number declaration/s by an employer or their intermediary. The TFND.0005 2019 and TFND.0004 2017 web service messages are exchanged using the ATO ebMS3 protocol with the …

Act) and is payable when an employer’s (or group of employers’) total Australian taxable wages exceed WA’s threshold amount of $850,000 per annum. From 1 July 2015, a gradual diminishing tax-free threshold was introduced. The Withholding declaration (PDF, 243KB) form (NAT 3093) is a fillable PDF that can be completed online, saved and printed. You will need to select each field to complete. If you prefer to complete by hand, print a blank copy of the form.

If you would like a range of forms and brochures, for yourself or for your employees, to be sent out to you, simply complete our online request form here. Employer Guide Everything you need to know about your super obligations and becoming a participating Hostplus employer, including the application form … Section 175AA of the Act prohibits an employer from avoiding compensation obligations by contriving to have his / her workers form their own companies, and engaging the companies instead of the workers (penalty: $2,000).

A statutory declaration form for each Australian state and territory is provided below. Please use the form for the state or territory where you will be signing the statutory declaration. Please use the form for the state or territory where you will be signing the statutory declaration. Section 175AA of the Act prohibits an employer from avoiding compensation obligations by contriving to have his / her workers form their own companies, and engaging the companies instead of the workers (penalty: $2,000).

Act) and is payable when an employer’s (or group of employers’) total Australian taxable wages exceed WA’s threshold amount of $850,000 per annum. From 1 July 2015, a gradual diminishing tax-free threshold was introduced. The forms on this page are downloadable documents. Employer's statutory declaration in support of an application for approval of an enterprise agreement (other than a greenfields agreement) Form F17 : Rules 24(1) and 24(2) Sch 1: Section 185 FW Act: Statutory declaration of employee organisation in relation to an application for approval of an enterprise agreement (other than a greenfields

Declaration that would terminate this Declaration (e.g., due to death of a partner, a change in residence of one partner, termination of the relationship, etc.). (INTERNET) Page 1 of 11 INDEPENDENT CONTRACTOR OR COMMON LAW EMPLOYEE FOR USE BY STATE AGENCIES The purpose of this article is to …

Employer Obligations (EO) Standard Business Reporting

INDEPENDENT CONTRACTOR OR COMMON LAW EMPLOYEE. REMEDIES FOR WRONGFUL OR UNFAIR TERMINATION 295 wages can then be met by a counter-claim for damages. But an employer has to be careful in this situation., employers and employees in respect of injuries or death caused by accidents arising out of and in the course of employment, or by prescribed occupational diseasesunder the Ordinance ..

GIO Workers Compensation

COMMON EMPLOYER/SPIN-OFFS Alberta. Statutory Declaration. Provision of the information requested on this form may be used for the purpose of declaring the existence of a common-law relationship under … Believing that this Declaration is a further important step forward for the recognition, promotion and protection of the rights and freedoms of indigenous peoples and in the development of relevant activities of the United Nations system in this field,.

employers and employees in respect of injuries or death caused by accidents arising out of and in the course of employment, or by prescribed occupational diseasesunder the Ordinance . Common Law Insurance A“ ct” means the Workers’ Compensation & Injury Management Act 1981 as amended and replaced from time to time, including any subordinate rules and regulations. “Acts of Terrorism” means any act (on or before the final day referred to in the Workers’ Compensation and Injury Management (Acts of Terrorism) Act 2001) including but not limited to the use of

• Employer’s Declaration Form, available from Housing SA. • Current payslip showing gross wages, including overtime, with year to date earnings or 6 to 8 weeks 10.1.1.3 Income Tax and Employment Declaration a) Income tax is deducted from all salaries in accordance with the income tax instalment rates issued by the Australian Taxation Office.

Employer declaration Tick the relevant box and fill in the appropriate details. No expenses payments or benefits of the type to be returned on forms P11D have been or will be provided for the year ended 5 April 2009. For this reason no forms P11D are attached. I confirm that all details of expenses payments and benefits that have to be returned on forms P11D for the year ended 5 April 2009 are 4 Common Law Contract of Employment - Most employees have no written contract of employment - Employment relationship can be subject to any agreed upon terms that do not offend statutes such as the Employment Standards Act, Human Rights Code, Occupational Health and Safety Act, Workers’ Compensation Act - In practice, employers dictate these terms To end employment relationship: - Employer

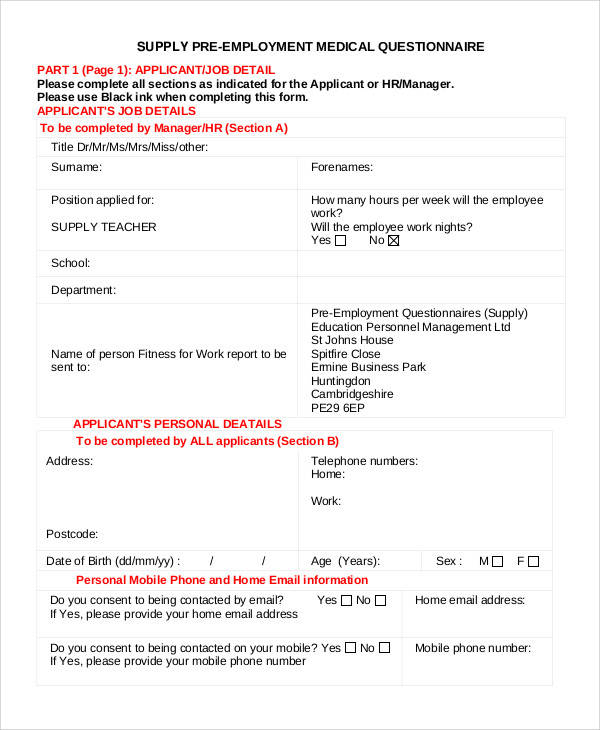

The form of evidence required by the Employer will depend on the circumstances of the carer’s leave request, and may include a medical certificate from a Registered Practitioner or statutory declaration … 10.1.1.3 Income Tax and Employment Declaration a) Income tax is deducted from all salaries in accordance with the income tax instalment rates issued by the Australian Taxation Office.

The Tax File Number Declaration (TFND) allows for the lodgment of a tax file number declaration/s by an employer or their intermediary. The TFND.0005 2019 and TFND.0004 2017 web service messages are exchanged using the ATO ebMS3 protocol with the … Claim form Workers’ Compensation and Rehabilitation Act 2003 Before making a claim, workers need to: • notify employers about injuries • see a doctor and get a workers’ compensation medical certificate.

Securiguard Services Limited, [2006] CIRB no. 359; and 132 CLRBR (2d) 299 (review of ministerial action) In this matter, the employer complained that the notice of dispute filed by the union pursuant to section 71 of the Code was invalid and asked the Board to set aside the subsequent appointment of a conciliation officer by the Minister of Labour. do hereby give notice in writing that I rescind my claim to right of action at common law to recover damages for personal injuries sustained while in the employment of the aforementioned employer.

The Tax File Number Declaration (TFND) allows for the lodgment of a tax file number declaration/s by an employer or their intermediary. The TFND.0005 2019 and TFND.0004 2017 web service messages are exchanged using the ATO ebMS3 protocol with the … Securiguard Services Limited, [2006] CIRB no. 359; and 132 CLRBR (2d) 299 (review of ministerial action) In this matter, the employer complained that the notice of dispute filed by the union pursuant to section 71 of the Code was invalid and asked the Board to set aside the subsequent appointment of a conciliation officer by the Minister of Labour.

1 APPLICATION FORM Important Note: All the fields in the Application Form are mandatory and must be completed in full. EASO reserves the right to disqualify candidates who do … • Employer’s Declaration Form, available from Housing SA. • Current payslip showing gross wages, including overtime, with year to date earnings or 6 to 8 weeks

4 Common Law Contract of Employment - Most employees have no written contract of employment - Employment relationship can be subject to any agreed upon terms that do not offend statutes such as the Employment Standards Act, Human Rights Code, Occupational Health and Safety Act, Workers’ Compensation Act - In practice, employers dictate these terms To end employment relationship: - Employer The Withholding declaration (PDF, 243KB) form (NAT 3093) is a fillable PDF that can be completed online, saved and printed. You will need to select each field to complete. If you prefer to complete by hand, print a blank copy of the form.

The Tax File Number Declaration (TFND) allows for the lodgment of a tax file number declaration/s by an employer or their intermediary. The TFND.0005 2019 and TFND.0004 2017 web service messages are exchanged using the ATO ebMS3 protocol with the … Division of Workers Compensation Main Forms page Self-Insured Employer Forms and Required Coverage Notices Electronic Filing: Forms available for electronic filing are indicated by . See Electronic Filing - Online Forms for more information about filing your PDF form online.

• Employer’s Declaration Form, available from Housing SA. • Current payslip showing gross wages, including overtime, with year to date earnings or 6 to 8 weeks declaration by employer or authorised person I hereby declare that the particulars, shown in items 1 to 40 of this report, of an alleged occupationall disease contracted by the employee, are to the best of my knowledge and belief true and accurate.