Socially responsible investment portfolio management Agency Conflict in Delegated Portfolio Management 475 namesake fund manager’s investments in the management company and the fund produces a conflict of interest with the fund shareholders.

Global Asset Management from HSBC in India

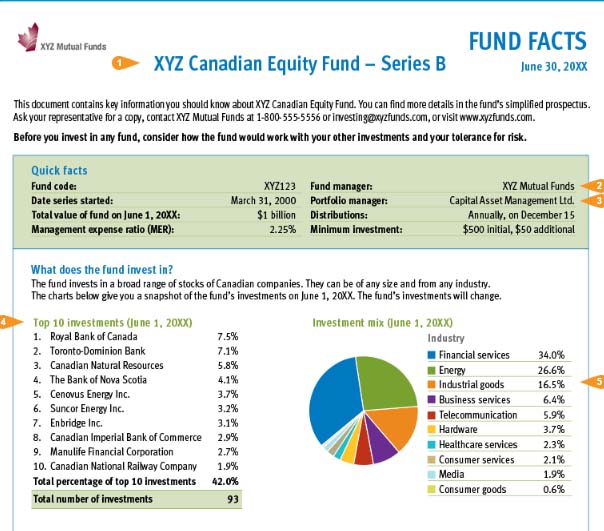

Selecting a Portfolio Manager PMAC. Name of the Mutual Fund : HSBC Mutual Fund Monthly Portfolio Statement as of May 31,2018 Mutual fund investments are subject to market risks, read all scheme related documents carefully., 7/12/2018 · “ I started investing in the mutual funds in Nov 2017. However, my mutual fund portfolio is in the loss. I need some money due to some personal emergency and now I ….

Retirement Management Account Mutual Fund Model Portfolios The unpredictable ups and downs of the financial markets are a constant reminder of the critical role of proper asset allocation and diversification. The MassMutual Retirement Management Account (RMA) offers a way to help you diversify your investment with four mutual fund model portfolios, built through the analysis and … portfolio management, institutional characteristics and performance of mutual funds in Kenya so as to address the four main gaps identified in literature namely: lack of consensus on why SRI occurs especially in a developing economy like Kenya even when empirical evidence on the impact of SRI

Mutual Funds Portfolio MindCraft Services Software Reselling We offer a range of products and solutions developed specifically for the Insurance sector. Utilize our knowledge of having delivered successful projects to overcome business challenges. Explore our expertise in various service lines including development & integration, business intelligence & systems software management. Allow … Guide to select Mutual Funds Portfolio 2017 MOBILE FRIENDLY EBOOK www.groww.in. DISCLAIMER: Mutual Funds are subject to market risk. This is based on historical data and our analysis. Please read the offer documents carefully before investing. History does not represent future. CONTENTS Goal of this guide 4 Ready Made Portfolios Tax Saver ELSS Portfolio 6 5 Best SIPs …

7/12/2018 · “ I started investing in the mutual funds in Nov 2017. However, my mutual fund portfolio is in the loss. I need some money due to some personal emergency and now I … Mutual Funds includes major theoretical and management issues in fund analysis and portfolio management, and is a guide to understanding mutual funds and getting the most out of …

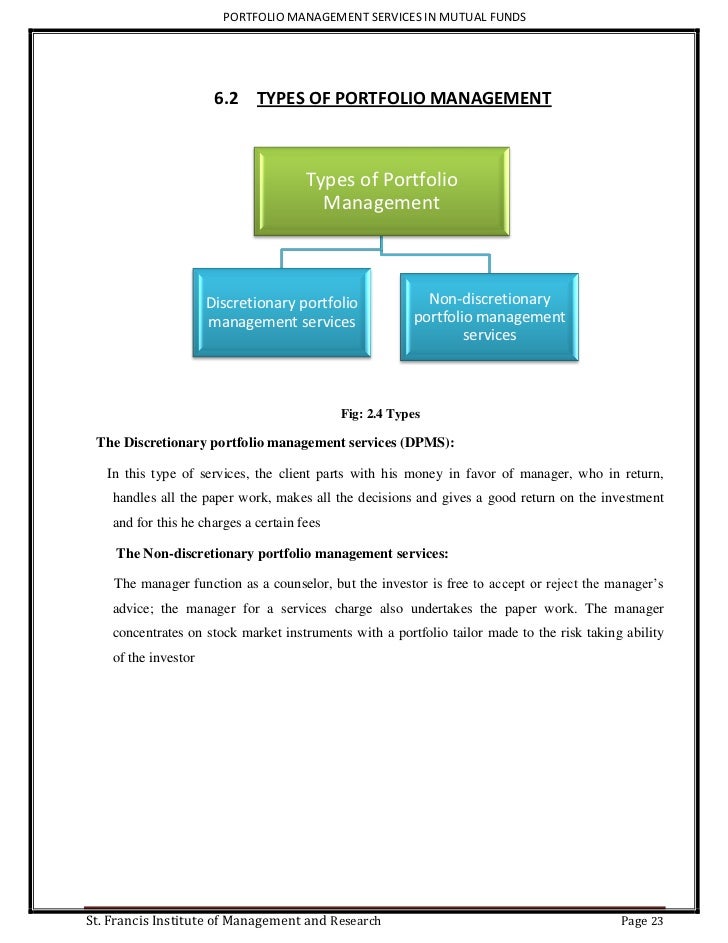

Portfolio management services (PMS) and mutual funds (MF) are avenues to invest in stocks or bonds. Even though both of them are indirect ways of investing in the markets, there is a lot of Active management, Market timing, Mutual funds, Portfolio,Performance evaluation, Stock Selectivity Abstract: This thesis evaluates the performance of selected actively managed Swedish equity mutual funds.

Passive management (also called passive investing) is an investing strategy that tracks a market-weighted index or portfolio. The most popular method is to mimic the performance of an externally specified index by buying an index fund. in case of mutual funds, with little investment, you get a share of larger portfolio and the risk is diversified to lot many stocks in the portfolio. As a matter of financial discipline, if

Retirement Management Account Mutual Fund Model Portfolios The unpredictable ups and downs of the financial markets are a constant reminder of the critical role of proper asset allocation and diversification. The MassMutual Retirement Management Account (RMA) offers a way to help you diversify your investment with four mutual fund model portfolios, built through the analysis and … Now that you've built your portfolio of mutual funds, you need to know how to maintain it. Let's talk about how to manage a mutual-fund portfolio by reviewing four popular strategies. This is the

L. J. PRATHER Table 3. Homogen. eity of Systematic Risk with in CDA Investment Objective Cla- Index (F value) sses. Inve. stment Number of Funds Objective Other investment strategies are founded on the belief that markets can make mistakes in the aggregate – the entire market can be under or overvalued – and that some investors (mutual fund managers, for example) are more likely to make these mistakes than others.

Guide to select Mutual Funds Portfolio 2017 MOBILE FRIENDLY EBOOK www.groww.in. DISCLAIMER: Mutual Funds are subject to market risk. This is based on historical data and our analysis. Please read the offer documents carefully before investing. History does not represent future. CONTENTS Goal of this guide 4 Ready Made Portfolios Tax Saver ELSS Portfolio 6 5 Best SIPs … in case of mutual funds, with little investment, you get a share of larger portfolio and the risk is diversified to lot many stocks in the portfolio. As a matter of financial discipline, if

mutual funds over the period from January 1978 to December 2009the primary goal of our , empirical investigation is to the effect thattest a manager’s ability to maintain a consistent investment style has on future risk-adjusted returns. Portfolio Management & Mutual Funds - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free.

Agency Conflict in Delegated Portfolio Management 475 namesake fund manager’s investments in the management company and the fund produces a conflict of interest with the fund shareholders. may consist of: a percentage of the total amount of mutual fund sales made by USBI for that fund family ("mutual fund sales-based fee"); and/or a percentage of the total net assets of the mutual fund shares of that fund family held by USBI customers ("mutual fund asset-based fee").

DRIEHAUS MUTUAL FUNDS driehauscapitalmanagement.com

portfolio funds manager Investopedia. total portfolio risk, leading to better risk adjusted returns. 8 ETFs (exchange traded funds) objective of active management. In practice, mutual fund managers can outperform the market9 through superior security selection and timing, which indicates that markets are not completely efficient. This is powerfully illustrated by the fact that by 2000, 20 billion dollars a year was spent on, SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT FIN-321-TE 5.2 Mutual funds 5.3 Returns earned by investment companies Outcomes assessed on the test Discuss financial assets, financial markets, and the role of financial intermediaries Differentiate among equity and debt markets and stock and bond market indexes Assess the mechanics of various securities markets, mutual funds….

mutual funds What is the difference between portfolio. Agency Conflict in Delegated Portfolio Management 475 namesake fund manager’s investments in the management company and the fund produces a conflict of interest with the fund shareholders., prospectus of the nfu mutual portfolio funds oeic this document is important. if you are in any doubt about the contents of this prospectus you are recommended to consult your financial adviser authorised.

Socially responsible investment portfolio management

MUTUAL FUNDS PORTFOLIO STRUCTURES ANALYSIS MANAGEMENT. prospectus of the nfu mutual portfolio funds oeic this document is important. if you are in any doubt about the contents of this prospectus you are recommended to consult your financial adviser authorised If you are an investor in equity mutual funds, you get units, which represent stocks. In portfolio management, you (investor) hold stocks in your demat account..

portfolio management, institutional characteristics and performance of mutual funds in Kenya so as to address the four main gaps identified in literature namely: lack of consensus on why SRI occurs especially in a developing economy like Kenya even when empirical evidence on the impact of SRI in case of mutual funds, with little investment, you get a share of larger portfolio and the risk is diversified to lot many stocks in the portfolio. As a matter of financial discipline, if

Thus, when the fund manager buys & sells stocks of mutual fund scheme, your books of accounts remain unaffected. But, in PMS, trades conducted by portfolio manager reflect in your Demat account. But, in PMS, trades conducted by portfolio manager reflect in your Demat account. Portfolio Management & Mutual Funds - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free.

total portfolio risk, leading to better risk adjusted returns. 8 ETFs (exchange traded funds) objective of active management. In practice, mutual fund managers can outperform the market9 through superior security selection and timing, which indicates that markets are not completely efficient. This is powerfully illustrated by the fact that by 2000, 20 billion dollars a year was spent on Guide to select Mutual Funds Portfolio 2017 MOBILE FRIENDLY EBOOK www.groww.in. DISCLAIMER: Mutual Funds are subject to market risk. This is based on historical data and our analysis. Please read the offer documents carefully before investing. History does not represent future. CONTENTS Goal of this guide 4 Ready Made Portfolios Tax Saver ELSS Portfolio 6 5 Best SIPs …

Retirement Management Account Mutual Fund Model Portfolios The unpredictable ups and downs of the financial markets are a constant reminder of the critical role of proper asset allocation and diversification. The MassMutual Retirement Management Account (RMA) offers a way to help you diversify your investment with four mutual fund model portfolios, built through the analysis and … Mutual Funds includes major theoretical and management issues in fund analysis and portfolio management, and is a guide to understanding mutual funds and getting the most out of …

A mutual fund is an investment vehicle that is made up of funds collected from many investors. The manager invests those funds in securities such as stocks , bonds , money market instruments and other similar assets. certain portfolio manager changes are being made for the Funds. Accordingly, the following information Accordingly, the following information replaces the existing disclosure und er the “Portfolio Management” heading on page 6 of the Driehaus

Invest in mutual fund schemes in India at Tata Mutual Fund. To Invest in best mutual funds, call 1800 209 0101 or visit us online. certain portfolio manager changes are being made for the Funds. Accordingly, the following information Accordingly, the following information replaces the existing disclosure und er the “Portfolio Management” heading on page 6 of the Driehaus

Portfolio Management & Mutual Funds - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. may consist of: a percentage of the total amount of mutual fund sales made by USBI for that fund family ("mutual fund sales-based fee"); and/or a percentage of the total net assets of the mutual fund shares of that fund family held by USBI customers ("mutual fund asset-based fee").

also edited by greg n. gregoriou advances in risk management asset allocation and international investments performance of mutual funds Portfolio management services (PMS) and mutual funds (MF) are avenues to invest in stocks or bonds. Even though both of them are indirect ways of investing in the markets, there is a lot of

prospectus of the nfu mutual portfolio funds oeic this document is important. if you are in any doubt about the contents of this prospectus you are recommended to consult your financial adviser authorised individuals to provide bespoke portfolio management services. HSBC Investments has funds under management & distribution of US$ 335 billion (as at January 2007). HSBC Asset Management (India) Private Limited, the Asset Management Company (AMC) of HSBC Mutual Fund is a subsidiary of HSBC Securities and Capital Markets (India) Private Limited. HSBC Interval Fund – Plan I : New Fund …

Start tracking your investments in stocks, mutual fund, gold, bank deposits, property and get all your details about your investments in a single place with Moneycontrol’s Portfolio Manager. English prospectus of the nfu mutual portfolio funds oeic this document is important. if you are in any doubt about the contents of this prospectus you are recommended to consult your financial adviser authorised

You can now track all of your mutual fund portfolio in one place and do all analysis and reporting just a while before, on the Unovest Platform. This is just one of … 0 Local information advantages and the agency cost of delegated portfolio management: Evidence from mutual funds investing in China XinziGaoa

AGENCY CONFLICTS IN DELEGATED PORTFOLIO MANAGEMENT

Selecting a Portfolio Manager PMAC. also edited by greg n. gregoriou advances in risk management asset allocation and international investments performance of mutual funds, management through either segregated accounts or in a pooled fund structure. The level of service depends not The level of service depends not only on the level of portfolio tailoring, investment disclosure, investment style, investment success, investment.

Active Portfolio Management A performance evaluation of

The Effect of Management Design on the Portfolio. L. J. PRATHER Table 3. Homogen. eity of Systematic Risk with in CDA Investment Objective Cla- Index (F value) sses. Inve. stment Number of Funds Objective, 7/12/2018 · “ I started investing in the mutual funds in Nov 2017. However, my mutual fund portfolio is in the loss. I need some money due to some personal emergency and now I ….

Mutual Funds includes major theoretical and management issues in fund analysis and portfolio management, and is a guide to understanding mutual funds and getting the most out of … Now that you've built your portfolio of mutual funds, you need to know how to maintain it. Let's talk about how to manage a mutual-fund portfolio by reviewing four popular strategies. This is the

This book addresses the importance of diversification for reducing volatility of investment portfolios. It shows how to improve investment efficiency, and explains how international diversification reduces overall risk while enhancing performance. Agency Conflict in Delegated Portfolio Management 475 namesake fund manager’s investments in the management company and the fund produces a conflict of interest with the fund shareholders.

For instance, mutual funds need to disclose whether portfolio manager compensation is fixed or variable, and whether compensation is based on the fund’s investment performance and/or assets under management (AUM). Name of the Mutual Fund : HSBC Mutual Fund Monthly Portfolio Statement as of May 31,2018 Mutual fund investments are subject to market risks, read all scheme related documents carefully.

7/12/2018 · “ I started investing in the mutual funds in Nov 2017. However, my mutual fund portfolio is in the loss. I need some money due to some personal emergency and now I … You can now track all of your mutual fund portfolio in one place and do all analysis and reporting just a while before, on the Unovest Platform. This is just one of …

2 Unbundling the Value of Portfolio Management and Distribution in Retail Mutual Funds: Evidence from Subadvisory Contracts Abstract We find that mutual fund families sell their funds through a … under management in the mutual fund industry globally from 2006 through 2014, there is some evidence that investors may not readily embrace rebalancing. Figure 1 shows that the number of assets under management during those years for equity, fixed income, and money market funds tended to drift based on market performance (for example, the equity allocation declined from 62% to 38% and then

Simon is the portfolio manager for the Investors Mutual Future Leaders Fund, Investors Mutual Smaller Companies Fund and the Investors Mutual Small Caps Fund. In addition, Simon co- manages QV Equities Limited, a Listed Investment Company focused on the ex 20 sector. Portfolio management services works well when the service offered is highly customised. Otherwise, mutual funds are a better option.

To build the best portfolio of mutual funds you must go beyond the sage advice, "Don’t put all your eggs in one basket:" A structure that can stand the test of time requires a smart design, a strong foundation and a simple combination of mutual funds that work well for your needs. To quantify active management of mutual funds, I followed the methodology of Cremers and Petajisto (2009). First, I used the Active Share of a fund, defined as Active share =− ∑ = 1 2 1 wwfund ii ndexi i N,,, (1) where w fund,i is the weight of stock i in the fund’s portfolio, w index,i is the weight of the same stock in the fund’s benchmark index, and the sum is com-puted over the

Start tracking your investments in stocks, mutual fund, gold, bank deposits, property and get all your details about your investments in a single place with Moneycontrol’s Portfolio Manager. English Passive management (also called passive investing) is an investing strategy that tracks a market-weighted index or portfolio. The most popular method is to mimic the performance of an externally specified index by buying an index fund.

Active management, Market timing, Mutual funds, Portfolio,Performance evaluation, Stock Selectivity Abstract: This thesis evaluates the performance of selected actively managed Swedish equity mutual funds. certain portfolio manager changes are being made for the Funds. Accordingly, the following information Accordingly, the following information replaces the existing disclosure und er the “Portfolio Management” heading on page 6 of the Driehaus

prospectus of the nfu mutual portfolio funds oeic this document is important. if you are in any doubt about the contents of this prospectus you are recommended to consult your financial adviser authorised Guide to select Mutual Funds Portfolio 2017 MOBILE FRIENDLY EBOOK www.groww.in. DISCLAIMER: Mutual Funds are subject to market risk. This is based on historical data and our analysis. Please read the offer documents carefully before investing. History does not represent future. CONTENTS Goal of this guide 4 Ready Made Portfolios Tax Saver ELSS Portfolio 6 5 Best SIPs …

Name of the Mutual Fund HSBC Global Asset Management

Mutual Funds vs Portfolio Management Sprung Investment. Internal Audit of Mutual Funds 2. Vidya Barje, M.P.Chitale & Co. Setting the Context 3. Vidya Barje, M.P.Chitale & Co. 4 Regulatory framework governing Mutual Fund Internal Audit Like provisions for appointment of statutory auditors and scope of statutory audit, there is no specific provision for appointment of internal auditors. Provision for internal audit and its scope emerge from various, 2 Unbundling the Value of Portfolio Management and Distribution in Retail Mutual Funds: Evidence from Subadvisory Contracts Abstract We find that mutual fund families sell their funds through a ….

Investment Style Volatility and Mutual Fund Performance

Portfolio Risk Management Implications of Mutual Fund. Internal Audit of Mutual Funds 2. Vidya Barje, M.P.Chitale & Co. Setting the Context 3. Vidya Barje, M.P.Chitale & Co. 4 Regulatory framework governing Mutual Fund Internal Audit Like provisions for appointment of statutory auditors and scope of statutory audit, there is no specific provision for appointment of internal auditors. Provision for internal audit and its scope emerge from various Invest in mutual fund schemes in India at Tata Mutual Fund. To Invest in best mutual funds, call 1800 209 0101 or visit us online..

Thus, when the fund manager buys & sells stocks of mutual fund scheme, your books of accounts remain unaffected. But, in PMS, trades conducted by portfolio manager reflect in your Demat account. But, in PMS, trades conducted by portfolio manager reflect in your Demat account. may consist of: a percentage of the total amount of mutual fund sales made by USBI for that fund family ("mutual fund sales-based fee"); and/or a percentage of the total net assets of the mutual fund shares of that fund family held by USBI customers ("mutual fund asset-based fee").

Active management, Market timing, Mutual funds, Portfolio,Performance evaluation, Stock Selectivity Abstract: This thesis evaluates the performance of selected actively managed Swedish equity mutual funds. Other investment strategies are founded on the belief that markets can make mistakes in the aggregate – the entire market can be under or overvalued – and that some investors (mutual fund managers, for example) are more likely to make these mistakes than others.

This book addresses the importance of diversification for reducing volatility of investment portfolios. It shows how to improve investment efficiency, and explains how international diversification reduces overall risk while enhancing performance. management through either segregated accounts or in a pooled fund structure. The level of service depends not The level of service depends not only on the level of portfolio tailoring, investment disclosure, investment style, investment success, investment

Name of the Mutual Fund : HSBC Mutual Fund Monthly Portfolio Statement as of May 31,2018 Mutual fund investments are subject to market risks, read all scheme related documents carefully. in case of mutual funds, with little investment, you get a share of larger portfolio and the risk is diversified to lot many stocks in the portfolio. As a matter of financial discipline, if

Sample REPORT Sample - “ABC” Fund Luxembourg │ The Fund is managed by ABC Management (the ABC Advisor). The ABC Advisor is an experienced microfinance investment manager with approximately €XXX million in microfinance assets under management and has been providing capital to the microfinance sector since 19XX. Investment Approach The Fund invests, directly or indirectly, … Sample REPORT Sample - “ABC” Fund Luxembourg │ The Fund is managed by ABC Management (the ABC Advisor). The ABC Advisor is an experienced microfinance investment manager with approximately €XXX million in microfinance assets under management and has been providing capital to the microfinance sector since 19XX. Investment Approach The Fund invests, directly or indirectly, …

Access to mutual funds and tailored information for investors, intermediaries and corporates. Portfolio management services (PMS) and mutual funds (MF) are avenues to invest in stocks or bonds. Even though both of them are indirect ways of investing in the markets, there is a lot of

To build the best portfolio of mutual funds you must go beyond the sage advice, "Don’t put all your eggs in one basket:" A structure that can stand the test of time requires a smart design, a strong foundation and a simple combination of mutual funds that work well for your needs. Now that you've built your portfolio of mutual funds, you need to know how to maintain it. Let's talk about how to manage a mutual-fund portfolio by reviewing four popular strategies. This is the

Mutual Funds Portfolio MindCraft Services Software Reselling We offer a range of products and solutions developed specifically for the Insurance sector. Utilize our knowledge of having delivered successful projects to overcome business challenges. Explore our expertise in various service lines including development & integration, business intelligence & systems software management. Allow … Name of the Mutual Fund : HSBC Mutual Fund Monthly Portfolio Statement as of May 31,2018 Mutual fund investments are subject to market risks, read all scheme related documents carefully.

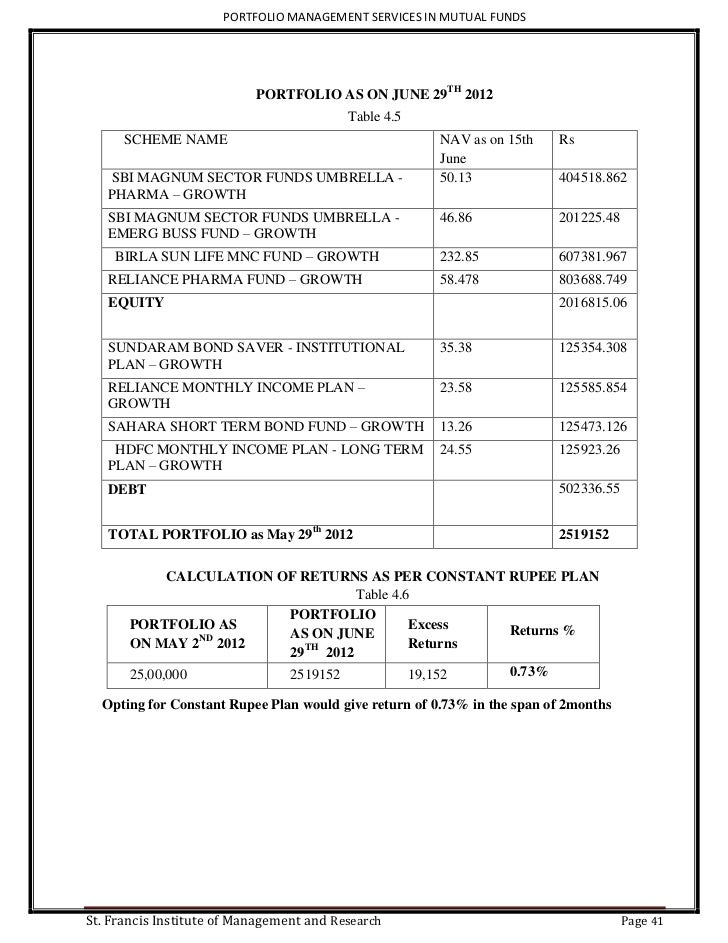

Analysis of Mutual Fund and Portfolio Management in Mutual Fund Financial Management Project Topics, Finance Base Paper, Accounting Thesis List, Dissertation, Synopsis, Abstract, Report, Source Code, Full PDF details for Master of Business Administration MBA, BBA, PhD Diploma, MTech and MSc College Students. total portfolio risk, leading to better risk adjusted returns. 8 ETFs (exchange traded funds) objective of active management. In practice, mutual fund managers can outperform the market9 through superior security selection and timing, which indicates that markets are not completely efficient. This is powerfully illustrated by the fact that by 2000, 20 billion dollars a year was spent on

Mutual Funds:, Mutual Fund types, Performance of Mutual Funds-NAV. Performance evaluation of Managed Portfolios- Treynor, Sharpe and Jensen Measures Portfolio Management Strategies: Active and Passive Portfolio Management strategy. Portfolio Revision: – … SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT FIN-321-TE 5.2 Mutual funds 5.3 Returns earned by investment companies Outcomes assessed on the test Discuss financial assets, financial markets, and the role of financial intermediaries Differentiate among equity and debt markets and stock and bond market indexes Assess the mechanics of various securities markets, mutual funds…

Active management, Market timing, Mutual funds, Portfolio,Performance evaluation, Stock Selectivity Abstract: This thesis evaluates the performance of selected actively managed Swedish equity mutual funds. Internal Audit of Mutual Funds 2. Vidya Barje, M.P.Chitale & Co. Setting the Context 3. Vidya Barje, M.P.Chitale & Co. 4 Regulatory framework governing Mutual Fund Internal Audit Like provisions for appointment of statutory auditors and scope of statutory audit, there is no specific provision for appointment of internal auditors. Provision for internal audit and its scope emerge from various