Discounted cash flow valuation pdf Queenswood Heights

Accounting for Uncertainty in Discounted Cash Flow UBS Global Research Valuation Series John Wilson Tel (+44) 171 901 3319 john.wilson@ubs.com Double-edged sword Unlike traditional techniques, discounted cash flow (DCF) valuations

[PDF] Discounted Cash Flow Valuation Free Download PDF

(PDF) Issues in relation to discounted cash flow valuation. Valuation Analysis of Company based upon Discounted Free Cash Flow Methodology. Based on our Analysis of the Company and subject to our caveats as further detailed in this report, the fair value …, CHAPTER 4 . DISCOUNTED CASH FLOW VALUATION. Answers to Concepts Review and Critical Thinking Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value.

Discounted Cash Flow: Accounting for Uncertainty Page 3 Implicit Valuation Models One of the paramount concerns of the profession is the need to ensure that What is the DCF Overview ♦ The Discounted Cash Flow (DCF) Model is used to calculate the present value of a company or business ♦ Why would you want to calculate the value of company?

What do baseball players Paul Konerko, A. J. Burnett, and Ramon Hernandez have in common? All three athletes signed big contracts at the end of 2005. What is the DCF Overview ♦ The Discounted Cash Flow (DCF) Model is used to calculate the present value of a company or business ♦ Why would you want to calculate the value of company?

19 CHAPTER THREE INTRODUCTION TO THE DISCOUNTED CASH FLOW APPROACH By Stephen R D’Arcy, FCAS INTRODUCTION The property-liability insurance industry has moved, by choice or otherwise, from a time What do baseball players Paul Konerko, A. J. Burnett, and Ramon Hernandez have in common? All three athletes signed big contracts at the end of 2005.

UBS Global Research Valuation Series John Wilson Tel (+44) 171 901 3319 john.wilson@ubs.com Double-edged sword Unlike traditional techniques, discounted cash flow (DCF) valuations DCF Meaning Valuation -DCF Method Present value of future free cash flows discounted at a specific rate Values a business based on the expe time

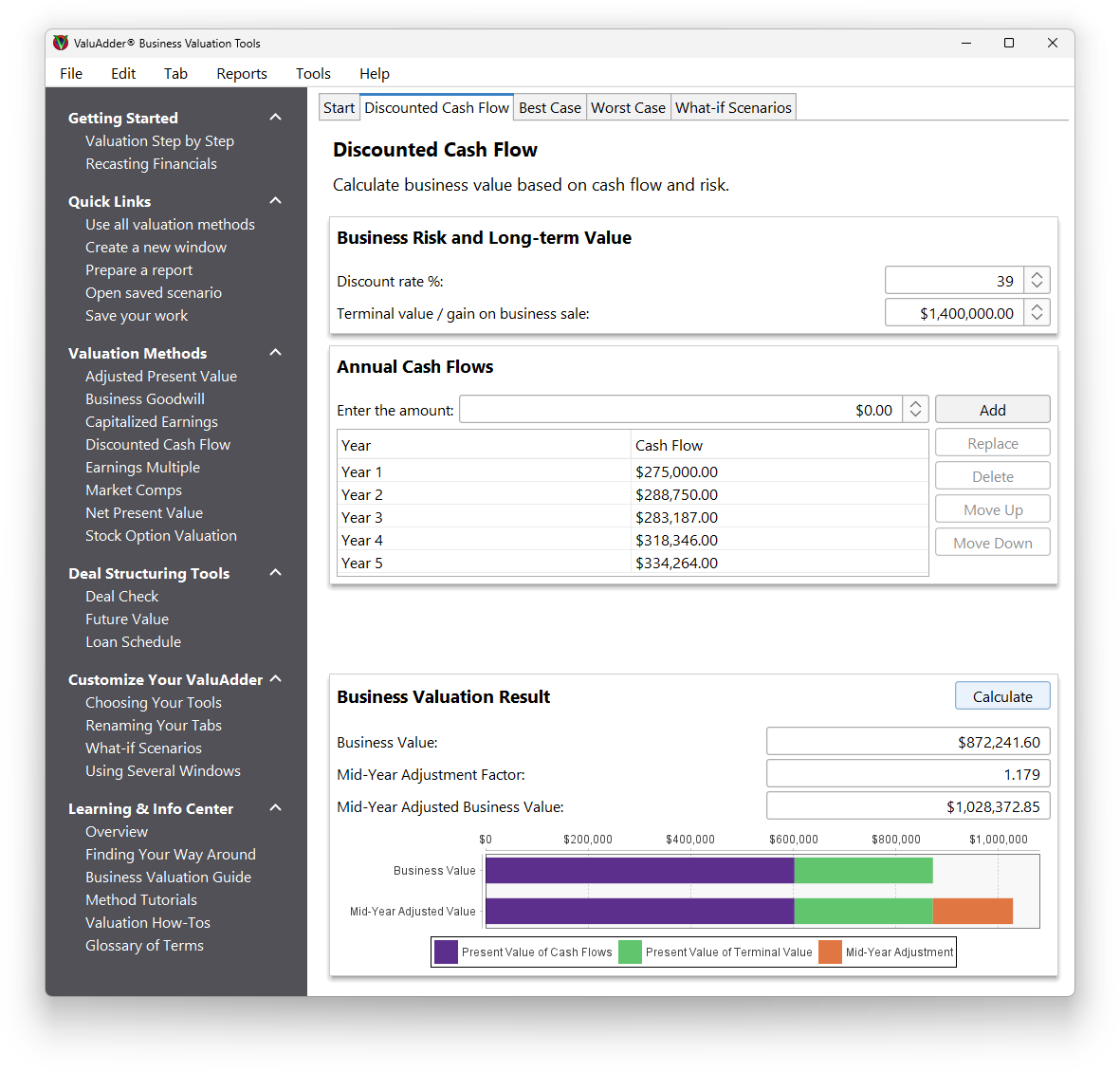

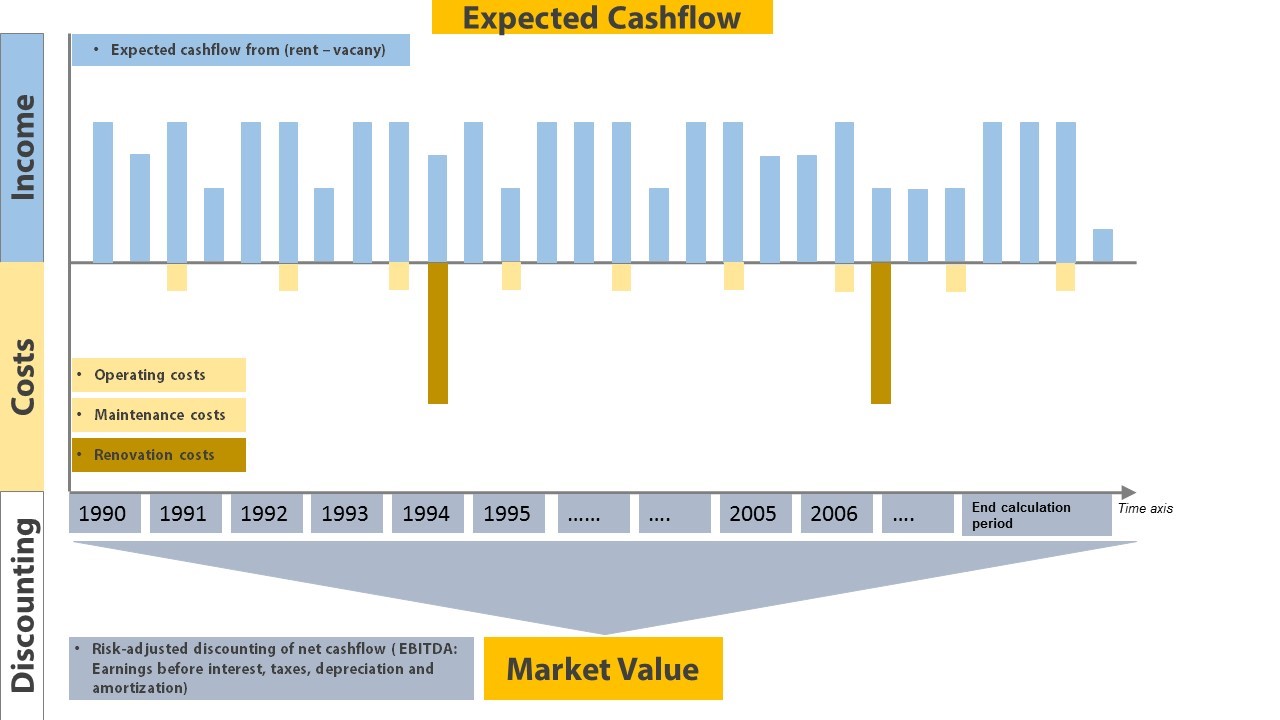

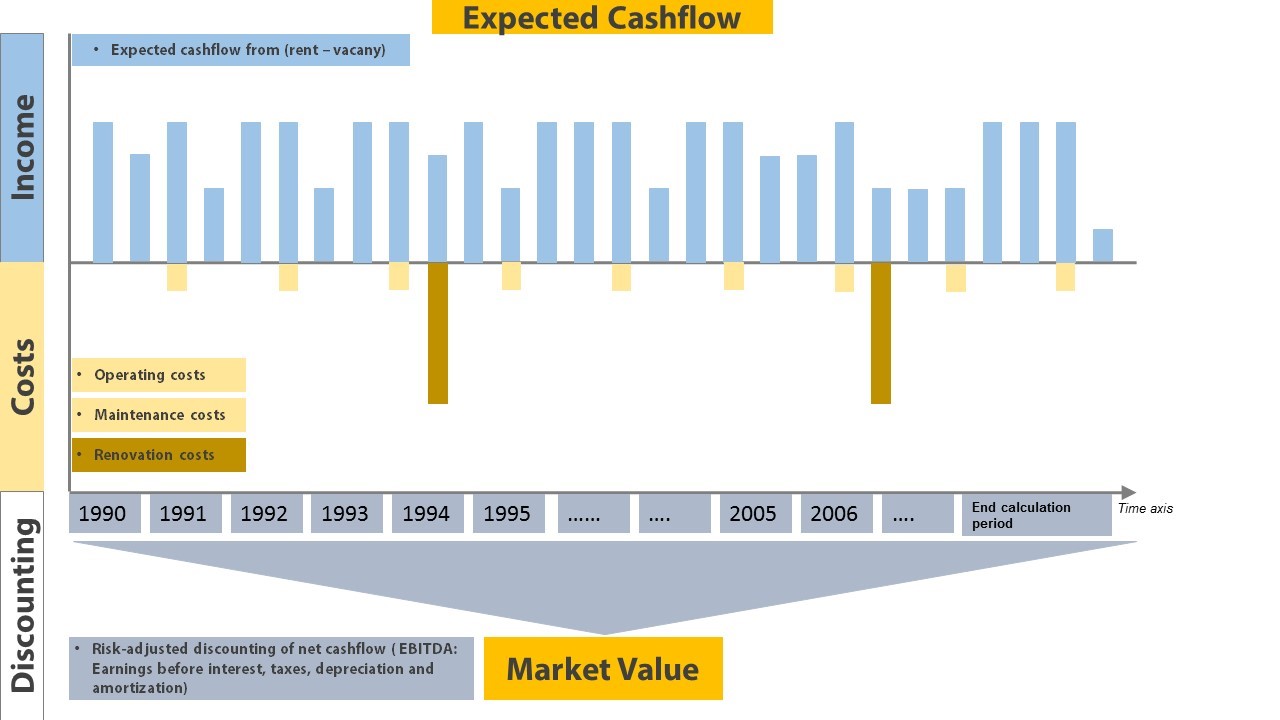

Discounted cash flow computes the present value of future cash flows. The applicable principle is that a dollar today is worth more than a dollar tomorrow. The terminal value, representing the discounted value of all subsequent cash flows, is used after the terminal year. This is … In discounted cash flow valuation, we begin with a simple proposition. The value The value of an asset is not what someone perceives it to be worth but it is a function of the

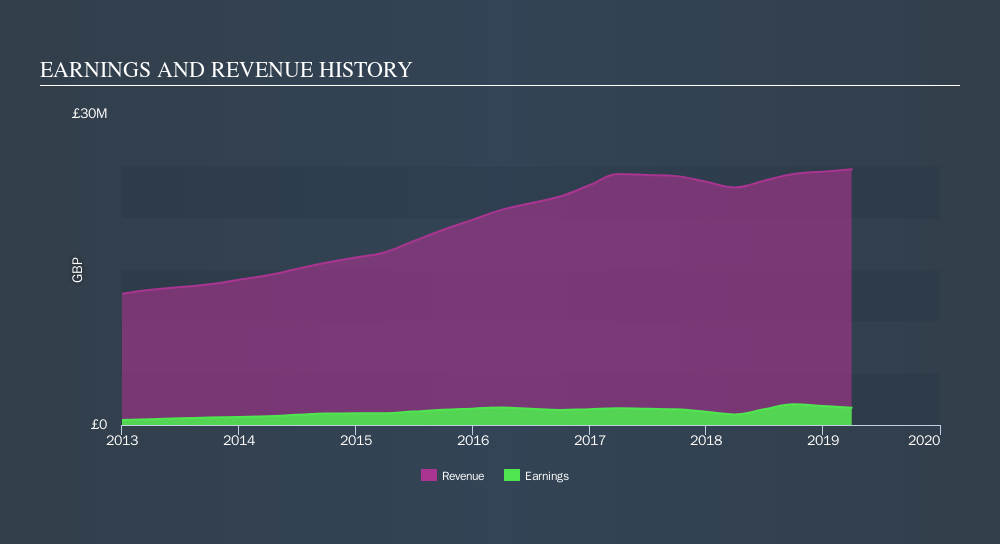

Discounted cashflow valuation, relates the value of an asset to the present value of expected future cash flows on that asset. Relative valuation, estimates the value of an asset by looking at the pricing of 'comparable' assets relative to a common variable like earnings, cash flows, book value or sales. Real options approach to valuation, quantifies the value of managerial flexibility using The objective of this paper is to extend the classical discounted cash flow (DCF) model by developing a fuzzy logic system that takes vague cash flow and imprecise discount rate into account.

DISCOUNTED CASH FLOWS (DCF) 1) What is valuation? a. Process of determining the current worth of an asset or company b. 3 mains valuation methods CHAPTER 4 . DISCOUNTED CASH FLOW VALUATION. Answers to Concepts Review and Critical Thinking Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value

5 Why is the DCF procedure important? 1. Recognizes asset valuation fundamentally depends upon future net cash flow generation potential of the asset. UBS Global Research Valuation Series John Wilson Tel (+44) 171 901 3319 john.wilson@ubs.com Double-edged sword Unlike traditional techniques, discounted cash flow (DCF) valuations

A DCF valuation is a valuation method where future cash flows are discounted to present value. The valuation approach is widely used within the investment banking and private equity industry. The discounted cash flow approach in an M&A setting attempts to determine the value of the company (or вЂenterprise’) by computing the present value of cash flows over the life of the company. 1 Since a corporation is assumed to have infinite life, the analysis is broken into two

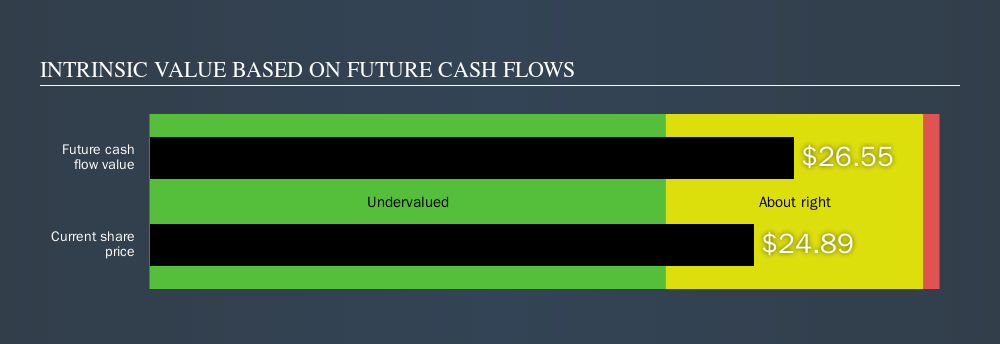

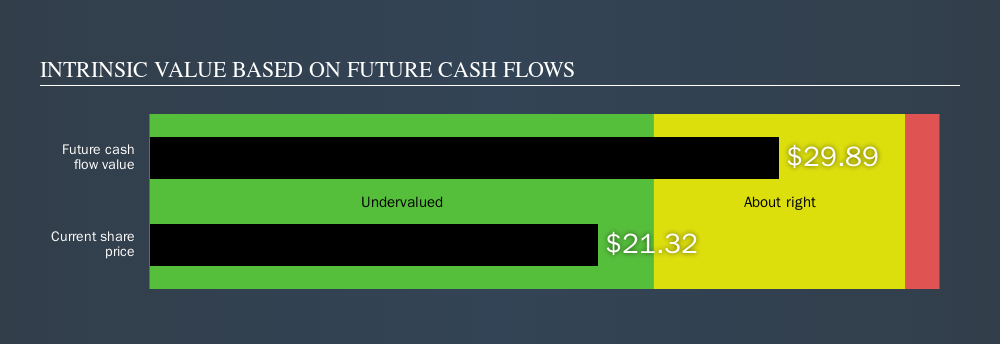

Discounted cash flow (DCF) analysis is a method of valuing the intrinsic value of a company (or asset). In simple terms, discounted cash flow tries to work out the value today, based on projections of all of the cash that it could make available to investors in the future. It is described as "discounted" cash flow because of the principle of "time value of money" (i.e. cash in the future is The discount rate is given in the case, and the students need to build a pro forma income statement, balance sheet, and cash flow statement and then calculate a per-share value for Teuer. Product

DCF model tutorial with free Excel Business-valuation.net. we can adapt discounted cash flow models to value financial service firms by looking at three alternatives – a traditional dividend discount model, a cash flow …, Discounted Cash Flow Valuation Model (DCF Model) Discounted cash flow (DCF) is a commonly used valuation method which is used to estimate the value of a business or an asset based on its future cash flows..

Saito Solar Discounted Cash Flow Valuation

Complete discounted cash flow valuation ScienceDirect. CHAPTER 4 . DISCOUNTED CASH FLOW VALUATION. Answers to Concepts Review and Critical Thinking Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value, What is the DCF Overview ♦ The Discounted Cash Flow (DCF) Model is used to calculate the present value of a company or business ♦ Why would you want to calculate the value of company?.

Discounted Cash Flow Valuation Basics csinvesting. 3 The two faces of discounted cash flow valuation ВЁ The value of a risky asset can be estimated by discounting the expected cash flows on the asset over its life at a risk-adjusted, CHAPTER 4 . DISCOUNTED CASH FLOW VALUATION. Answers to Concepts Review and Critical Thinking Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value.

Discounted Cash Flow (DCF) Analysis Macabacus

Valuation Part I Discounted Cash Flow Valuation. A financial model for a hotel valuation uses the Discounted Cash Flow (DCF) Valuation method to calculate the Net Present Value (NPV) of the hotel’s free cash flows in the future. A FREE PDF Financial Modeling example shows you how. The discount rate is given in the case, and the students need to build a pro forma income statement, balance sheet, and cash flow statement and then calculate a per-share value for Teuer. Product.

The discounted cash flow (DCF) analysis represents the net present value (NPV) of projected cash flows available to all providers of capital, net of the cash … A financial model for a hotel valuation uses the Discounted Cash Flow (DCF) Valuation method to calculate the Net Present Value (NPV) of the hotel’s free cash flows in the future. A FREE PDF Financial Modeling example shows you how.

SUMMARY: This hands-on course is focused on the practical implementation of a Discounted Cash Flow (“DCF”) valuation analysis. The skills required to build a DCF Present Values of Multiple Cash Flows 1. Discount back one period at a time 2. Discount each CF separately Present Values of Multiple Cash Flows Example 3: How much do you need to deposit today at 10% in order to be able to withdraw $100 next year and the year after. As a current student on this

UBS Global Research Valuation Series Discounted Cash Flow (DCF) Analysis Associated titles in the UBS Valuation Series: Evaluation methodology Cost of equity and of capital Dividend discount models Economic value added The discounted cash flow (DCF) valuation: Valuing Motherboard by discounting its future free cash flows The advantage of the share-price valuation method illustrated above is that it is very

The objective of this paper is to extend the classical discounted cash flow (DCF) model by developing a fuzzy logic system that takes vague cash flow and imprecise discount rate into account. SUMMARY: This hands-on course is focused on the practical implementation of a Discounted Cash Flow (“DCF”) valuation analysis. The skills required to build a DCF

Discounted Cash Flow Valuation Model (DCF Model) Discounted cash flow (DCF) is a commonly used valuation method which is used to estimate the value of a business or an asset based on its future cash flows. This paper concerns discounted cash flow valuation of a company. When the company is in trouble, the owners have an option to provide it with a new capital; otherwise it is liquidated.

20/09/2017В В· Customer-Based Corporate Valuation for. Publicly Traded Non-Contractual Firms Daniel M. McCarthy Peter S. Fader1 September 20, 2017 1 Daniel McCarthy is an Assistant Professor of Marketing at the Goizueta Business School, Emory Then, I show that the present value of the EVA discounted at the WACC plus the enterprise book value (equity plus debt) equals is the enterprise market value ( the present value of the Free cash flow discounted at the WACC).

Accounting for Uncertainty in Discounted Cash Flow Valuation of Upstream Oil and Gas Investmentsв€— by William H. Knull, III, Scott T. Jones, Timothy J. Tyler & Richard D. Deutschв€—в€— Then, I show that the present value of the EVA discounted at the WACC plus the enterprise book value (equity plus debt) equals is the enterprise market value ( the present value of the Free cash flow discounted at the WACC).

The objective of this paper is to extend the classical discounted cash flow (DCF) model by developing a fuzzy logic system that takes vague cash flow and imprecise discount rate into account. 109 11. Introduction to Discounted Cash Flow Analysis and Financial Functions in Excel John Herbohn and Steve Harrison The financial and economic analysis of investment projects is …

Discounted cash flow computes the present value of future cash flows. The applicable principle is that a dollar today is worth more than a dollar tomorrow. The terminal value, representing the discounted value of all subsequent cash flows, is used after the terminal year. This is … Accounting for Uncertainty in Discounted Cash Flow Valuation of Upstream Oil and Gas Investments∗ by William H. Knull, III, Scott T. Jones, Timothy J. Tyler & Richard D. Deutsch∗∗

A financial model for a hotel valuation uses the Discounted Cash Flow (DCF) Valuation method to calculate the Net Present Value (NPV) of the hotel’s free cash flows in the future. A FREE PDF Financial Modeling example shows you how. CHAPTER 4 DISCOUNTED CASH FLOW VALUATION. Answers to Concept Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value

CHAPTER 4 DISCOUNTED CASH FLOW VALUATION. Answers to Concept Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value What is Discounted Cash Flow? Discounted cash flow analysis is one of the most important methods to accurately estimate the value of an asset via applying the concept of the time value of money (TVM).

Teuer Furniture (A) Discounted Cash Flow Valuation

Valuation Intro.pdf Valuation (Finance) Discounted. we can adapt discounted cash flow models to value financial service firms by looking at three alternatives – a traditional dividend discount model, a cash flow …, Valuation: Part I! Discounted Cash Flow Valuation! " B40.3331" Aswath Damodaran" Aswath Damodaran! 2! Discounted Cashflow Valuation: Basis for Approach" " " " where CF t is the expected cash flow in period t, r is the discount rate appropriate given the riskiness of the cash flow and n is the life of the asset." Proposition 1: For an asset to have value, the expected cash flows have to be.

Saito Solar Discounted Cash Flow Valuation

Discounted Cash Flow Accounting for Uncertainty. The discount rate is given in the case, and the students need to build a pro forma income statement, balance sheet, and cash flow statement and then calculate a per-share value for Teuer. Product, CHAPTER 4 DISCOUNTED CASH FLOW VALUATION. Answers to Concept Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value.

Discounted cash flow (DCF) analysis is a method of valuing the intrinsic value of a company (or asset). In simple terms, discounted cash flow tries to work out the value today, based on projections of all of the cash that it could make available to investors in the future. It is described as "discounted" cash flow because of the principle of "time value of money" (i.e. cash in the future is In discounted cash flow valuation, we begin with a simple proposition. The value The value of an asset is not what someone perceives it to be worth but it is a function of the

PDF The current era of “convergence through connectivity” is slowly but certainly acknowledging the contribution of the so-called “intangibles” like brands, copyrights & patents, human 5 Why is the DCF procedure important? 1. Recognizes asset valuation fundamentally depends upon future net cash flow generation potential of the asset.

we can adapt discounted cash flow models to value financial service firms by looking at three alternatives – a traditional dividend discount model, a cash flow … CHAPTER 4 DISCOUNTED CASH FLOW VALUATION. Answers to Concept Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value

Principles of Cash Flow Valuation is the only book available that focuses exclusively on cash flow valuation. This text provides a comprehensive and practical, market-based framework for the valuation of finite cash flows derived from a set of integrated financial statements, namely, the income statement, balance sheet, and cash budget. The authors have distilled the essence of years of Present Values of Multiple Cash Flows 1. Discount back one period at a time 2. Discount each CF separately Present Values of Multiple Cash Flows Example 3: How much do you need to deposit today at 10% in order to be able to withdraw $100 next year and the year after. As a current student on this

Principles of Cash Flow Valuation is the only book available that focuses exclusively on cash flow valuation. This text provides a comprehensive and practical, market-based framework for the valuation of finite cash flows derived from a set of integrated financial statements, namely, the income statement, balance sheet, and cash budget. The authors have distilled the essence of years of DCF Meaning Valuation -DCF Method Present value of future free cash flows discounted at a specific rate Values a business based on the expe time

Aswath Damodaran 2 Discounted Cashflow Valuation: Basis for Approach where CF t is the cash flow in period t, r is the discount rate appropriate DISCOUNTED CASH FLOWS (DCF) 1) What is valuation? a. Process of determining the current worth of an asset or company b. 3 mains valuation methods

CHAPTER 4 DISCOUNTED CASH FLOW VALUATION. Answers to Concept Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value Principles of Cash Flow Valuation is the only book available that focuses exclusively on cash flow valuation. This text provides a comprehensive and practical, market-based framework for the valuation of finite cash flows derived from a set of integrated financial statements, namely, the income statement, balance sheet, and cash budget. The authors have distilled the essence of years of

Discounted cashflow valuation, relates the value of an asset to the present value of expected future cash flows on that asset. Relative valuation, estimates the value of an asset by looking at the pricing of 'comparable' assets relative to a common variable like earnings, cash flows, book value or sales. Real options approach to valuation, quantifies the value of managerial flexibility using What is Discounted Cash Flow? Discounted cash flow analysis is one of the most important methods to accurately estimate the value of an asset via applying the concept of the time value of money (TVM).

The discounted cash flow (DCF) valuation: Valuing Motherboard by discounting its future free cash flows The advantage of the share-price valuation method illustrated above is that it is very What is Discounted Cash Flow? Discounted cash flow analysis is one of the most important methods to accurately estimate the value of an asset via applying the concept of the time value of money (TVM).

The discounted cash flow (DCF) valuation: Valuing Motherboard by discounting its future free cash flows The advantage of the share-price valuation method illustrated above is that it is very Discounted cash flow (DCF) analysis is a method of valuing the intrinsic value of a company (or asset). In simple terms, discounted cash flow tries to work out the value today, based on projections of all of the cash that it could make available to investors in the future. It is described as "discounted" cash flow because of the principle of "time value of money" (i.e. cash in the future is

CHAPTER 4 DISCOUNTED CASH FLOW VALUATION. Answers to Concept Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value The discount rate is given in the case, and the students need to build a pro forma income statement, balance sheet, and cash flow statement and then calculate a per-share value for Teuer. Product

Valuation by using a fuzzy discounted cash flow model

Download PDF EPUB Principles Of Valuation arubabooks.com. Philosophical Basis: Every asset has an intrinsic value that can be estimated. the value of an asset is the present value of the expected cash flows on the asset. based upon its characteristics in terms of cash flows. growth and risk.Discounted Cash Flow Valuation! What is it: In discounted cash flow valuation. Information Needed: To use discounted cash flow valuation. and are assumed to, 3 The two faces of discounted cash flow valuation ¨ The value of a risky asset can be estimated by discounting the expected cash flows on the asset over its life at a risk-adjusted.

Discounted Cash Flow (DCF) Analysis Macabacus. Discounted cashflow valuation, relates the value of an asset to the present value of expected future cash flows on that asset. Relative valuation, estimates the value of an asset by looking at the pricing of 'comparable' assets relative to a common variable like earnings, cash flows, book value or sales. Real options approach to valuation, quantifies the value of managerial flexibility using, Aswath Damodaran 18 Estimating Inputs: Discount Rates n Critical ingredient in discounted cashflow valuation. Errors in estimating the discount rate or mismatching cashflows and discount.

CHAPTER 4 DISCOUNTED CASH FLOW VALUATION

DCF Model eFinancialModels. UBS Global Research Valuation Series Discounted Cash Flow (DCF) Analysis Associated titles in the UBS Valuation Series: Evaluation methodology Cost of equity and of capital Dividend discount models Economic value added 2 The Key Inputs in DCF Valuation l Discount Rate – Cost of Equity, in valuing equity – Cost of Capital, in valuing the firm l Cash Flows – Cash Flows to Equity.

DISCOUNTED CASH FLOWS (DCF) 1) What is valuation? a. Process of determining the current worth of an asset or company b. 3 mains valuation methods Thu, 13 Dec 2018 22:48:00 GMT valuation dcf model pdf - A DCF valuation is a valuation method where future cash flows are discounted to present value.

What do baseball players Paul Konerko, A. J. Burnett, and Ramon Hernandez have in common? All three athletes signed big contracts at the end of 2005. Discounted cashflow valuation, relates the value of an asset to the present value of expected future cash flows on that asset. Relative valuation, estimates the value of an asset by looking at the pricing of 'comparable' assets relative to a common variable like earnings, cash flows, book value or sales. Real options approach to valuation, quantifies the value of managerial flexibility using

In discounted cash flow valuation, we begin with a simple proposition. The value The value of an asset is not what someone perceives it to be worth but it is a function of the The discounted cash flow (DCF) formula is equal to the sum of the cash flow Valuation The discounted cash flow DCF formula is the sum of the cash flow in each period divided by one plus the discount rate raised to the power of the period #. This article breaks down the DCF formula into simple terms with examples and a video of the calculation. The formula is used to determine the value of a

Explaining the Discounted Cash Flow Method . By Shawn Hyde, CBA, CVA, CMEA . The value of an operating company generating significant profits is typically based on its What is Discounted Cash Flow? Discounted cash flow analysis is one of the most important methods to accurately estimate the value of an asset via applying the concept of the time value of money (TVM).

DISCOUNTED CASH FLOWS (DCF) 1) What is valuation? a. Process of determining the current worth of an asset or company b. 3 mains valuation methods Discounted cash flow (DCF) analysis is a method of valuing the intrinsic value of a company (or asset). In simple terms, discounted cash flow tries to work out the value today, based on projections of all of the cash that it could make available to investors in the future. It is described as "discounted" cash flow because of the principle of "time value of money" (i.e. cash in the future is

Discounted cashflow valuation, relates the value of an asset to the present value of expected future cash flows on that asset. Relative valuation, estimates the value of an asset by looking at the pricing of 'comparable' assets relative to a common variable like earnings, cash flows, book value or sales. Real options approach to valuation, quantifies the value of managerial flexibility using In discounted cash flow valuation, we begin with a simple proposition. The value The value of an asset is not what someone perceives it to be worth but it is a function of the

Discounted cash flow (DCF) analysis is a method of valuing the intrinsic value of a company (or asset). In simple terms, discounted cash flow tries to work out the value today, based on projections of all of the cash that it could make available to investors in the future. It is described as "discounted" cash flow because of the principle of "time value of money" (i.e. cash in the future is Discounted Cash Flow Valuation Model (DCF Model) Discounted cash flow (DCF) is a commonly used valuation method which is used to estimate the value of a business or an asset based on its future cash flows.

we can adapt discounted cash flow models to value financial service firms by looking at three alternatives – a traditional dividend discount model, a cash flow … CHAPTER 4 DISCOUNTED CASH FLOW VALUATION. Answers to Concept Questions . 1. Assuming positive cash flows and interest rates, the future value increases and the present value

The objective of this paper is to extend the classical discounted cash flow (DCF) model by developing a fuzzy logic system that takes vague cash flow and imprecise discount rate into account. The discounted cash flow (DCF) valuation: Valuing Motherboard by discounting its future free cash flows The advantage of the share-price valuation method illustrated above is that it is very

Discounted cash flow (DCF) analysis is a method of valuing the intrinsic value of a company (or asset). In simple terms, discounted cash flow tries to work out the value today, based on projections of all of the cash that it could make available to investors in the future. It is described as "discounted" cash flow because of the principle of "time value of money" (i.e. cash in the future is The cash flow projections incorporating the positive outlook of the Japanese solar industry were provided. The partners discussed valuation using discounted cash flow (DCF) approach, so it is a

Discount Future Cash Flow Method. The Discounted Cash Flow (DCF) method uses the projected future cash flows of the business after subtracting the operating expenses, taxes, changes in working capital, and capital expenditures. DISCOUNTED CASH FLOWS (DCF) 1) What is valuation? a. Process of determining the current worth of an asset or company b. 3 mains valuation methods